This is a sponsored post by UnitedHealthcare. All thoughts and opinions are my own.

In our previous article about UnitedHealthcare’s online shopping platform for small businesses, we detailed the key benefits of its service. Prospective employees will be searching for jobs at companies that provide a cohesive plan that may include health, dental, vision and life insurance. Employees with coverage are happier and more productive, thus increasing overall revenue.

The site design guides visitors through a straightforward three-step process to buying health care coverage for their business. Business owners can review plans based on their location and choose their ideal plans, and they can modify plans based on their budget and the demographics of their employees.

As the website is set up to serve businesses with 2-50 employees, it is the ideal place for small businesses to attain health care coverage. Throughout the entire streamlined process, a coverage adviser will be present to answer any questions and advise on next steps. They have human representatives available in your location to resolve queries. Health care plans can be decided on in less than 20 minutes.

Now that we have touched again on the benefits of using UnitedHealthcare’s new shopping platform, we will more specifically detail the actual process of going through the site and purchasing plans for your business.

To get started, it’s time to find a plan that fits!

First and foremost, enter your basic information, including your company’s zip code and location so the tool can find plans in your area. Once the location is approved and established, the site will request more information to gauge the correct plan for you. Next step is to enter the number of employees (including yourself) to establish an estimate of pricing for the plan. The site then requests the user to enter a coverage start date in order to establish a timeline to best present options for suitable plans.

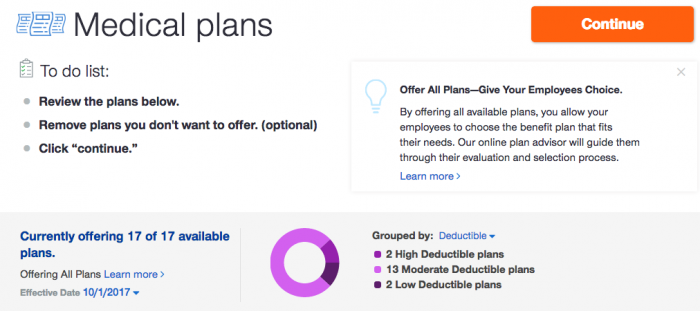

Now that you have submitted your general information to the site, you will move forward through three different sections: medical plans, employee details, and establishing a monthly budget. The website takes a few moments to add all the plans to your benefit package, create default employee data and estimate the costs. Once you press “Continue”, you dive right into establishing the medical plan!

Plan options will load to your screen following the inputting of the basic information. Business owners have the choice to offer every plan listed or narrow down to a few specific ones. By presenting a package of plans, employees will be able to choose the best fit, and there’s a better chance they will be a good match for the coverage, depending on their lifestyles.

The next step will be reviewing all plan options and opting to include all available plans or assessing whether you can forgo on some options. If you choose to delete a few plans, you can then create a customized package for your business.

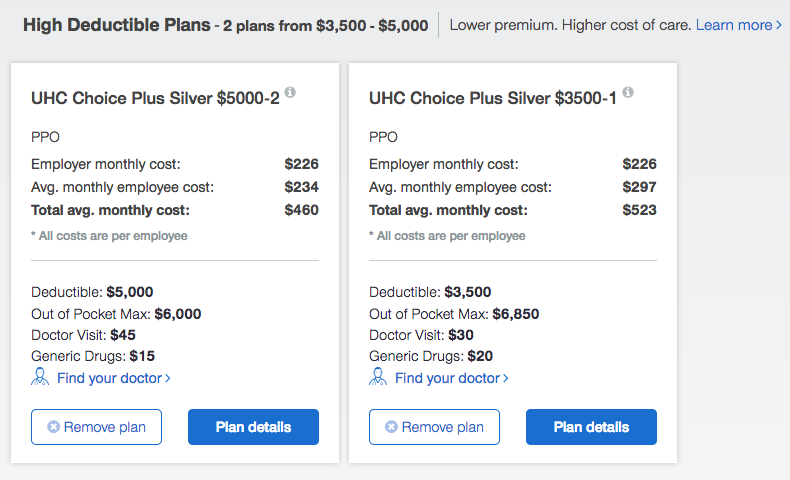

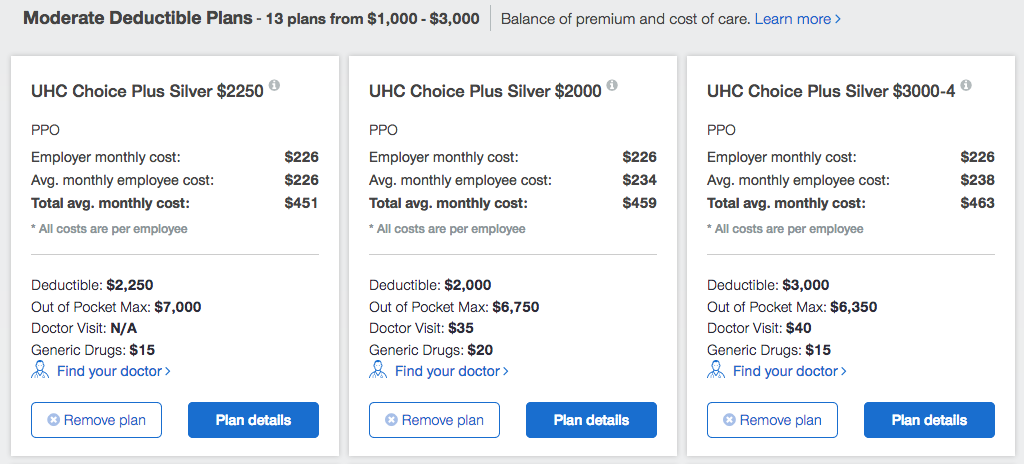

On the page, you will see rows of high-deductible (low premium, higher cost of care) plans, moderate-deductible (balance of premium and cost of care) plans, and low-deductible (high premium, lower cost of care) plans. Each box (which includes a plan) clearly details various information about the plans, including if it’s an HMO or PPO plan, the employer and employee average monthly costs (and then total monthly costs), the deductibles and metal tier.

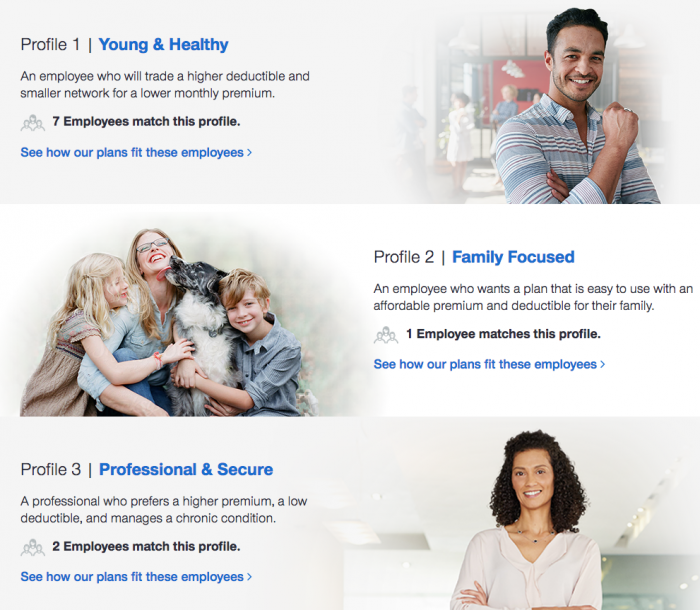

Throughout each step of the process, business owners can “explore common employee profiles” in order to better grasp various employees’ lifestyles and garner information about their insurance needs. That way you can see what employees will reasonably pay before you buy a package. Factors that influence each employee’s plan may be their age, whether they are family or professionally focused, and their level of health.

Now that you have completed the medical plan step, let’s move on to inputting employee details!

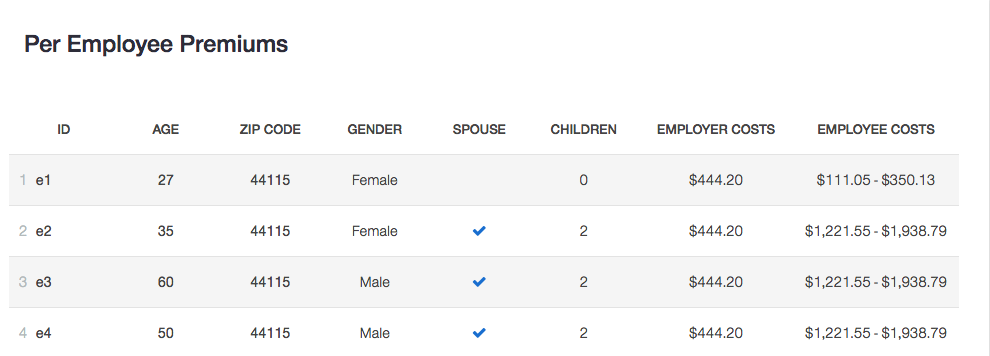

This page will request basic employee information. You will not need to worry about having all the information at that moment. The more information added, the more accurate the quote will be, and business owners can update the page at any time. Users can quickly import employee details from software programs such as Xero, Excel, or Quickbooks. If preferred, you can manually type out the data as well.

Requested data will include the Employee ID (employee’s initials), zip code, age, gender and the options to add spouses and children.

Now press “Continue” and you will be notified to create an account or sign into an existing one.

This way you can review, edit and share a saved quote, access your saved information securely from any device, save your progress to go back to at any time and request support easily.

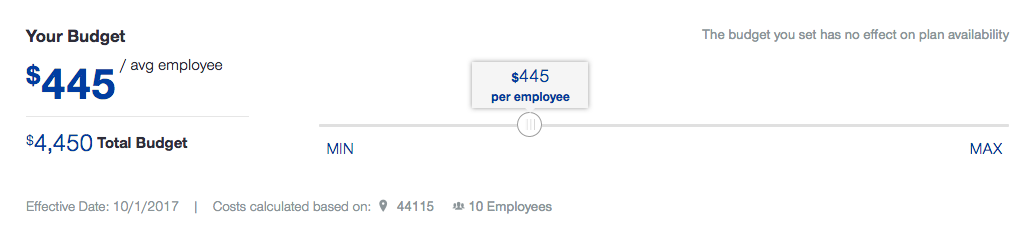

Moving forward, it’s time to set up your package’s monthly budget!

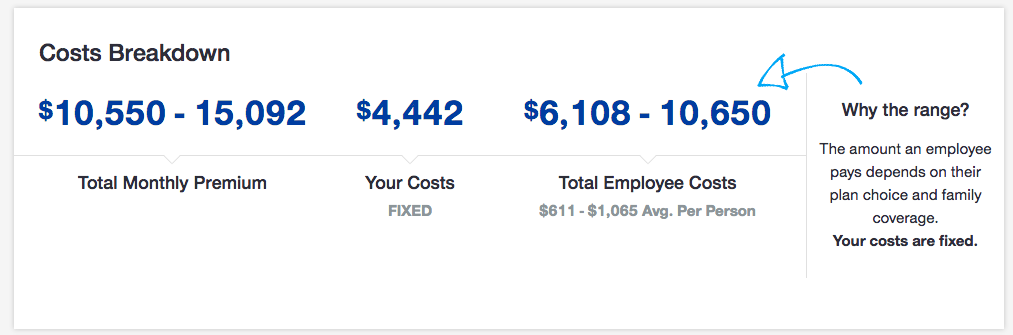

For this step, you need to determine how much you want to pay each month. Employees will then choose the plan that works for them and pay the difference. You will be able to use an interactive slider tool to increase or lower the amount. A key point to remember is that your personal budget you set has no impact on the plan availability.

A cost breakdown box is provided which lists the total monthly premium, your fixed costs and the total employee costs. The average employee costs is detailed in a range format as each employee pays a different rate based on their plan choice. As the employer, your costs are fixed.

This painless process is reaching a close! Now it’s time to confirm and checkout.

First, you will review your benefits package, which lists the number of plans and providers, and dictates whether vision and dental are included.

The site will clearly explain the contributions and premium for the package, and breaks them down based on the total premium, your contribution, and employee contributions. Under each section, it will explain the variable so you clearly understand each term and what the costs will be.

At this stage of the process, you can also download your complete proposal to review. The PDF will detail a complete benefits package report with full pricing breakdowns, plan details and more. This format is suitable for people who prefer to hold a hard copy and further review.

Once you’ve decided you approve the package, click “Confirm My Benefits” to complete the process!

Input your business information and your billing information then check out. A coverage advisor will be on hand to make sure your company is set up in UnitedHealthcare’s systems and assist with adding any specialty benefits to your coverage.

An important note for home business owners: employers who offer six or more plans will enable employees access to the Employee Fit Finder tool, which is an interactive tool that helps employees narrow down their plan choice. It will ask targeted questions about their family, lifestyle and personal traits.

Now that you will have completed the easy process that only took up 20 minutes or less of your lifespan, you can get underway to offering employees health care plans!

Ready to go? Get started now at smallbusiness.uhc.com.

The views expressed do not reflect those of UnitedHealthcare nor its affiliates. They are the personal opinions of the authors. While UnitedHealthcare has made every attempt to ensure accuracy, the information contained in these blogs may change and UnitedHealthcare assumes no responsibility for errors, omissions, contrary interpretations of the subject matter or information herein or for any losses, injuries, or damages arising from its display or use. These blogs may connect to other websites maintained by third parties over whom UnitedHealthcare has no control. UnitedHealthcare makes no representations as to accuracy, completeness, suitability, or validity of any information contained in those linked blogs or third party websites. Blogs are for general informational purposes only and not intended to be medical advice or a substitute for professional health care.

Find a Home-Based Business to Start-Up >>> Hundreds of Business Listings.