BizBuySell.com, the Internet’s largest business-for-sale marketplace, reported today that annual small business transactions ascended to record highs in 2017, exceeding previous highs set in 2016 by 27 percent. The full results are included in BizBuySell’s 2017 Q4 and year-end Insights Report, which aggregates statistics from business-for-sale transactions reported by participating business brokers nationwide.

This year’s increase marks a noteworthy upward shift in the number of small businesses changing hands across America. For several years after the 2008-2009 Great Recession, sales volume remained low as small businesses struggled financially and capital for financing remained tight. Beginning in 2013, as the economy recovered, closed transactions have steadily increased. But 2017 represents a significant increase, with 9,919 closed transactions reported compared to the 7,842 in 2016. This year-over-year growth rate is the largest since 2013.

To get a better understanding of what’s driving this high transaction volume, BizBuySell surveyed over 5,000 business brokers to get their expert opinions on the market. When asked for the top reason for the increase in transactions, brokers cited the improving small business environment, including strengthening revenue and profit numbers (28 percent), the increasing number of owners looking to sell (21 percent) and the increasing number of qualified buyers on the market (19 percent). While brokers attribute transaction growth to more of both qualified buyers and sellers, 42 percent of brokers believe the current market favors buyers, while 30 percent say it leans toward sellers, and just 25 percent describe the market as balanced.

“Since I am almost ‘sold out’, my biggest challenge for 2018 is more listings. But I have a healthy pool of buyers,” one broker said. Another broker said “it is a combination of more owners willing to sell and SBA financing available to more buyers” that are driving transactions. Others called out increasing buyer confidence and a stronger national economic outlook as driving forces.

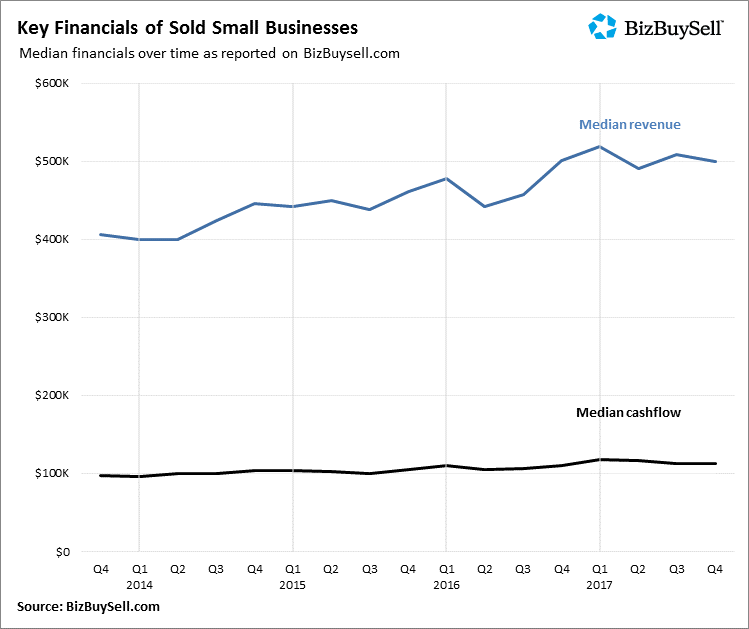

BizBuySell’s data supports this positive broker sentiment, with small business financials at the strongest point since data collection started in 2007. The median revenue of sold businesses grew 5.8 percent this year, from $472,798 in 2016 to $500,000 in 2017. Median cash flow also increased almost 7 percent, up to $115,000 from $107,551 the year prior.

Stronger financials allowed owners to list their business for more, with asking prices jumping 11 percent to a median of $250,000. As the higher prices are attached to more valuable businesses, buyers are driving median sale prices to increase 14 percent in 2017 to $227,880. Business owners are likely aware of the trend and are looking to take advantage. This is especially true for retirement seeking Baby Boomers, who sat out the recession waiting for business values to recover. In fact, 58 percent of surveyed business brokers associated more than half of their 2017 sales to Baby Boomer owners.

“For four years now, we’ve seen steady growth in the small business market, with reported transaction totals in the 7,000s range. Last year, however, seems to represent a new tier of activity that brings a lot of momentum into 2018,” Bob House, President of BizBuySell.com and BizQuest.com, said. “It’s exciting to see the number of sellers, particularly Baby Boomers, who were able to close better deals and that there remains a growing supply of buyers excited to enter the small business market.”

Franchise Sales Helped Spur Transaction Increase, Retail Financials Keeping Steady Despite Rise of Amazon and Ecommerce

BizBuySell data shows that the franchise market created much growth in 2017. In fact, closed transactions of existing franchised business locations made a 45 percent leap in 2017 compared to 2016. Within the annual 2017 data, roughly 9.5 percent of reported transactions were franchised businesses. Franchise financials seemed to follow suit during the final months of 2017. In the fourth quarter, franchise median revenue grew 22 percent and cash flow bumped up 8 percent. This led to significant increases in asking prices, which were up 27 percent, and final sale prices, which grew 20 percent to $210,000.

Industry-wise, retail has been a hot topic with new pressures coming from online sales giants like Amazon. Speculation is stirring that the company will also consider acquiring another retailer in 2018. However, 2017 continued to show strong retail financials on the small business front. In fact, median revenue for sold retail businesses jumped 17 percent, up to $600,000 from $513,000 just a year ago. The median sale price of those sold retail shops grew in conjunction with the revenue, up 11 percent to $199,500.

Q4 Ended Strong, Projecting 2018 to be Another Great Year to Buy or Sell a Small Business

BizBuySell’s Q4 2017 data revealed similarly strong numbers as the year-end totals, led by a 23 percent increase in transactions compared to the same period in 2016.

Again in sync with year-end totals, financials improved as well. While median revenue remained flat year-over-year, median cash flow rose to $112,504. Asking prices rose 4 percent to $250,000 but more significantly, the median sale price of sold businesses in Q4 jumped nearly 12 percent from $206,000 to $230,000. The median sale price rising faster than the asking prices could point to more established buyers willing to pay more healthy listings.

After such a strong year, indicators suggest that the momentum will continue into the new year. In fact, according to BizBuySell’s December survey, 80 percent of business brokers expect the number of business-for-sale transactions to improve again in 2018. Sale prices will no doubt be a hot topic in 2018 as 90 percent of brokers believe prices will either remain consistent with 2017’s numbers or continue to increase in the new year. Continuing another 2017 trend, nearly 3 out of 4 brokers expect more boomer business owners to enter the market in 2018.

With buyers attracted to stronger financials and an increasing number of confident millennials and too-early-to retire Boomers looking for entrepreneur opportunities, signs point to a continuation of growth in the small business market.

“Overall, the small business market has reached new level of buying and selling in 2017,” House said. “It will be interesting to see how the recently passed GOP tax reform affects activity, but as long as small business financials continue to remain strong and buyer confidence high, the market should continue its momentum well into 2018.”

About the BizBuySell.com Insight Report

BizBuySell.com is the Internet’s largest marketplace for buying or selling a small business, with over 1.4 million monthly visitors. The company releases its BizBuySell.com Insight Report on a quarterly basis, reporting changes in closed transaction rates, valuation multiples and other economic indicators for the small business transaction market. Closed transactions are reported to BizBuySell.com on a voluntary basis by business brokers nationwide. To find a qualified business broker in your area, visit http://www.bizbuysell.com/business-brokers/.

NOTE: For additional statistics, please see the latest BizBuySell Insights Report

About BizBuySell

BizBuySell is the Internet’s largest business for sale marketplace. Since 1996, BizBuySell has offered tools that make it easy for business owners and brokers to sell a business, and potential buyers to find the business of their dreams. BizBuySell currently has an inventory of approximately 45,000 businesses – spanning 80 countries – for sale at any one time and receives more than 1.4 million monthly visits. The site also features an extensive franchise directory as well as an easy-to-use business valuation tool. Please visit www.bizbuysell.com for more information.

BizBuySell was founded in 1996 and in 2012 became a division of CoStar Group, Inc. (NASDAQ – CSGP) – commercial real estate’s leading provider of information and analytic services. CoStar conducts expansive, ongoing research to produce and maintain the largest and most comprehensive database of commercial real estate information and offers a suite of online services enabling clients to analyze, interpret and gain unmatched insight on commercial property values, market conditions and current availabilities. For more information, visit www.costar.com.

Find a Home-Based Business to Start-Up >>> Hundreds of Business Listings.