A home is most consumers’ largest financial assets and biggest ongoing expense, yet, most homeowners are unorganized and spend more time and money managing their home than necessary. When you ask people about where they keep all the data and information about their home, the answer is usually paper documents scattered everywhere in the home, some notepads with to-do lists, and maybe a spreadsheet and digital photo somewhere. Most people would admit that the information about their home is incomplete.

Owning a Home Is Costly

Many homeowners forget or don’t know what preventative maintenance tasks to do, which causes expensive and unnecessary repair costs and higher energy bills. Most homeowners are over-budget on remodel projects and are under-insured with their home insurance policy. Many people don’t know their home’s value, mortgage balance, home equity or total cost of ownership.

Personal Finance App for Homeowners

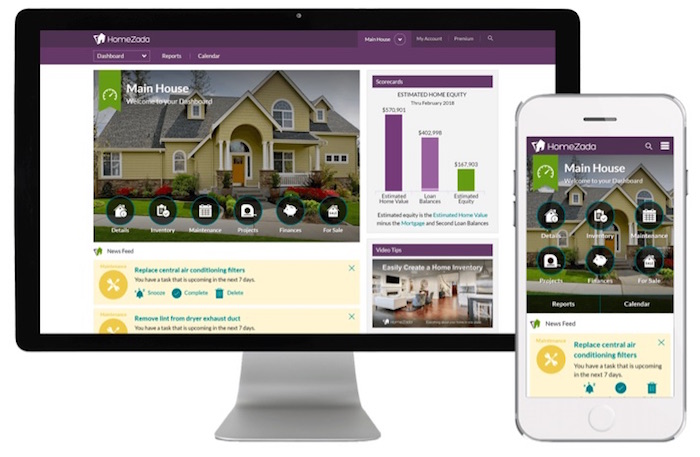

HomeZada is a new personal finance app that is specific to helping all homeowners financially manage their home. It combines multiple apps, content and data in a private and secure account to empower homeowners to make better and more timely decisions throughout the entire journey of owning and managing a home. HomeZada does the work for homeowners by using templates to create a lot of data and information about their specific homes.

Asset Values

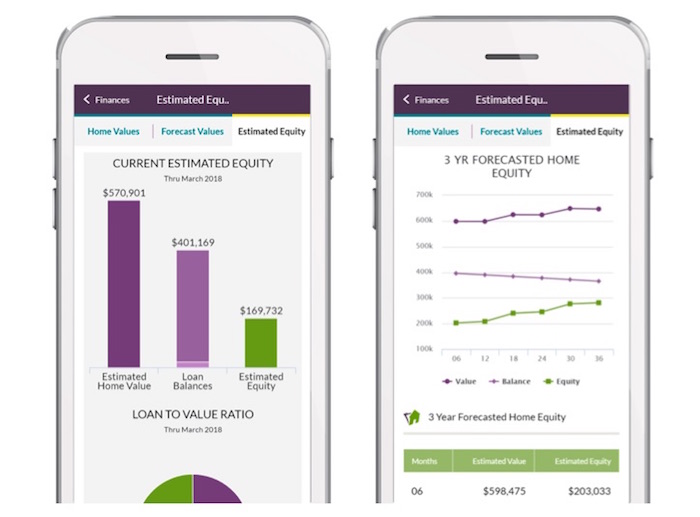

Financially speaking, your home and all your personal property inside it are considered assets. The value of your home is changing all the time with local real estate marketing conditions. Your mortgage balance is also changing with every mortgage payment you make. And the difference between the two is your home equity, which is a big part of your overall net worth. HomeZada automatically tracks and updates you with this important information, giving you constant visibility into your home’s value and your home equity.

Every home insurance company recommends that you have a home inventory. HomeZada makes it super easy to create one with either photos, videos and using AI technology to help create your list of personal property. This helps make sure you are properly insured and are prepared in case a fire or other disaster destroys your home.

Home Expenses

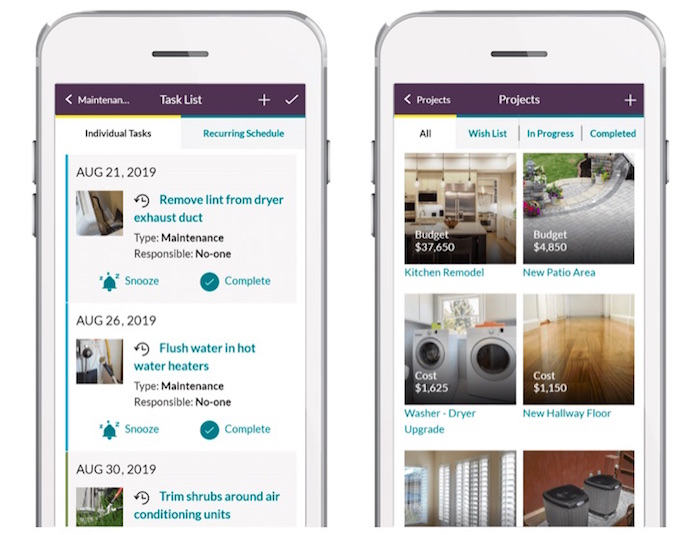

Many homeowners forget to budget for annual maintenance and minor fix-it tasks. They also don’t create financial budgets and track costs for larger remodel projects. In addition, people forget about property taxes, insurance costs, utility costs, and other regular home service costs.

HomeZada makes tracking all these expenses really easy. Over 50 common home remodel templates help create budgets for these projects. A household budgeting system creates the most common expenses to track. And a simple formula helps create a maintenance budget and track expenses.

Inspiration for All Homeowners

Elizabeth Dodson is one of the co-founders of HomeZada. She had the inspiration for the idea after being a frustrated homeowner herself with paper and spreadsheets scattered everywhere and, thus, spending too much on her home. Her inspiration was recently rewarded a Top Female Founder designation in a Fintech competition run by Quesnay and sponsored by Wells Fargo, Equifax, Discover, Valley Bank and NASDAQ. Elizabeth’s app now helps homeowners in the US and around the world save money and time in managing their home. It is also a great story about female entrepreneurs leading the way.

Find a Home-Based Business to Start-Up >>> Hundreds of Business Listings.