In today’s economy, there is a lot of uncertainty. This can cause people to be more cautious with their spending and how they manage cash flow. It can also make it more difficult for business owners that work from home or have a home-based office. There are many ways to manage your cash flow so that you don’t end up in financial trouble when running your own business from the comfort of your own living room! Let’s take a look at our top 7.

- Think about ways you can encourage your customers to pay you sooner, or even up front! For instance, could you offer a small discount for paying early or up front? Or could it be milestone specific — based on the time frames that you have to pay out suppliers related to the work? Often it can be as simple as letting new customers know that this is how you do business.

- Keep an average of three to six months of your average monthly expenses as cash at bank, to manage your risk during times when work opportunities are less available. It might take you a bit of time to save any profits you make to the point where you hit this benchmark, but creating a “cash cushion” for a rainy day is how some of the world’s largest companies survived receivership during tough times or major competitor activity. It works just as well for any home-based business.

- Be wary of signing up for too many monthly subscriptions. These pesky things can end up costing you a lot of money, without you even realising it. One way to keep on top of this is to report on all your subscription costs every month. Check how many users you have on each subscription. That extra $20 or $40 a month across multiple months and multiple subscriptions can equal thousands of savings per year.

- Do some research into the benefits of different business financing options. For instance, if you have enough cash to invest in bonds or another low-risk type financial investment strategy which increases in value at say 7% per annum. Then at the same time you’re able to get a business loan for 2.5% per annum — you’re effectively making 4.5% per annum, all while leveraging the bank’s money.

- Get a great bookkeeper! Life will become much simpler with a bookkeeper at your side. You got into business to do what you love, not to manage finances, right? They’ll keep your accounts clean, ensure your business and personal finances are separated, and they can often provide quick, easy cash flow reporting to you on a weekly basis so you’re always clear on your cash position. Be careful about relying on looking at how much cash is in your business bank as a way of determining your cash position.

- Stay mindful of the timing around when you need to pay your suppliers. If you have a supplier that has given you 30 days credit terms, then don’t purchase anything from them if it will take more than 31 days for their product to arrive. This is another way that cash can flow out of your business faster than into it — paying early doesn’t mean getting any discount off the price! Paying late does not give discounts either. So always make sure there’s enough in reserve before buying new items or ordering inventory from vendors.

- Find yourself a good accountant who can help you with the tax implications of your business. They’ll know which expenses are deductible, and which aren’t. They’ll also be able to advise on how profitable your business could become if it was more efficient — that’s not just in terms of profits but also in time management!

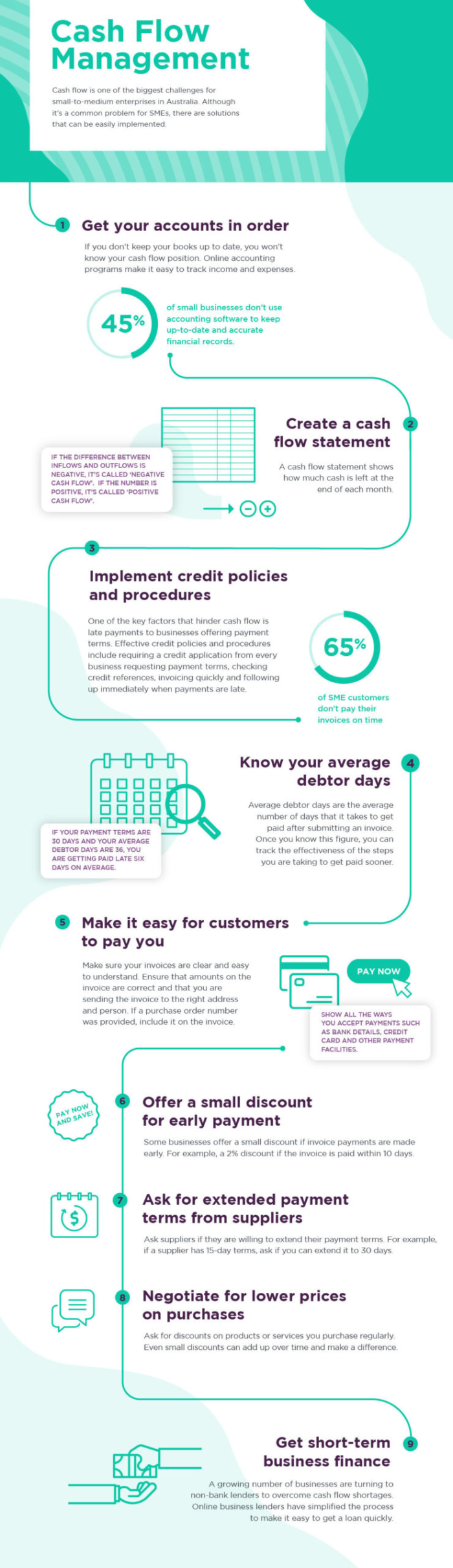

There are so many ways to manage business cash flow effectively — this infographic does a great job of summarising a few more.

Find a Home-Based Business to Start-Up >>> Hundreds of Business Listings.