Bitcoin is emerging as a lucrative investment that provided both traders and investors spectacular returns. Some traders and investors consider it the new “Gold”, some consider it a hedge in times of uncertainties. Stances vary but one thing is obvious, Bitcoin is more and more present in investors’ and traders’ portfolios.

In this article we compare Gold to Bitcoin and discuss trading approaches to benefit from both.

Similarities Between Bitcoin and Gold

Bitcoin and Gold have multiple similarities. They are both portable and convertible into fiat currencies, offer anonymity and are decentralized.

This decentralization and lack of governmental control makes them both appeal to investors concerned about the following:

- The state of Governments’ finances and how they can repay their debts

- Banks’ exposure to sovereign debts

- Governments weakening currencies to encourage exports

- Inflation

Therefore, both Gold and Bitcoin appeal to investors with a similar sentiment of “distrust” in the current economic system and looking for alternatives that could offer a certain “safe haven” aspect.

In addition to appealing to investors with a similar sentiment, both Gold and Bitcoin achieved a wide and universal acceptance. In fact, Bitcoin is starting to be considered a commodity in many countries because of its interchangeability.

In Japan, it is officially recognised as a currency and a store of value. Hence, Bitcoin, just like Gold, is considered a commodity, a store of value and even a currency depending on the country, the context and the parties involved in the trade.

Differences Between Bitcoin and Gold

One of the main differences between Bitcoin and Gold is the tangible aspect of Gold versus the virtual aspect of Bitcoin. The maturity level of these markets varies rather significantly, which is one of the reasons Bitcoin’s price is extremely volatile.

Unlike Gold, Bitcoin also tends to fluctuate in response to positive or negative technical developments in the underlying technology as well as the sector. This is another factor leading to wide price variances in a rather short horizon. Compared to Gold and even the conventional stock market, Bitcoin is very volatile. This is an aspect both traders and investors need to consider when thinking of how to trade Bitcoin. For if it is used to their advantage, volatility can yield superior returns.

In general, trading Bitcoin or investing in Bitcoin requires at a minimum a basic understanding of the technical aspect of Cryptocurrencies. Because the underlying technology is relatively new, this is an aspect that makes Bitcoin and Cryptocurrencies more appealing to traders and investors that are comfortable with the risk of investing in a rather new technology such as Cryptocurrencies. In this aspect, Bitcoin differs from Gold as the latter remains the top choice for conservative investors.

All in all, Gold’s general acceptance and trust levels were established over centuries as it was always considered a “safe haven” asset. Nowadays, it is impressive to see how Bitcoin is also shaping up to have its distinct place in many portfolios. Especially considering the multitude of options available today to both investors and traders to gain exposure to this booming market.

Bitcoin Trading approach

How to trade Bitcoin and how to maximise returns? A key question with varying answers. What is important for traders to consider: what is the goal they are trying to achieve, how much capital they have allocated or that they could access using leverage, and most important their time horizon.

Answering those questions will help them choose the trading style and approach that will help them achieve their goals. We have identified 3 winning approaches to trading Bitcoin:

Approach # 1: Bitcoin as a long-term investment

Buy and hold for the very long term (year or more). To get the maximum returns on investment using this approach, scoring an entry at a low-cost price is very important.

Once a position is initiated, investors need to be able to monitor the investment and overall Bitcoin performance and at the same time withstand the sharp price fluctuations.

Think of those who bought Bitcoin in 2013 and sold it in 2014 or those who bought in 2015 and sold in 2016 or 2017.

A good way to mitigate risk is a scaling approach so instead of one entry, investors could split the funds allocated for the trade into 2 or 3 tranches. This approach is known as Dollar Cost Averaging.

Approach # 2: Swing trading Bitcoin

This approach consists of buying important dips in bitcoin price and selling when the price has a major run then wait for the price to revisit the breakout level to re-initiate a position. If executed successfully, it could yield major returns in a relatively short timeframe especially when comparing these returns to conventional stocks or event ETFs.

Because Bitcoin is likely to respond to technical news (both positive and negative ones) this tends to cause volatility in the sector and could be lucrative for disciplined traders. Shorting the tops is also an option but comes with a higher risk level.

Approach # 3: Day trading

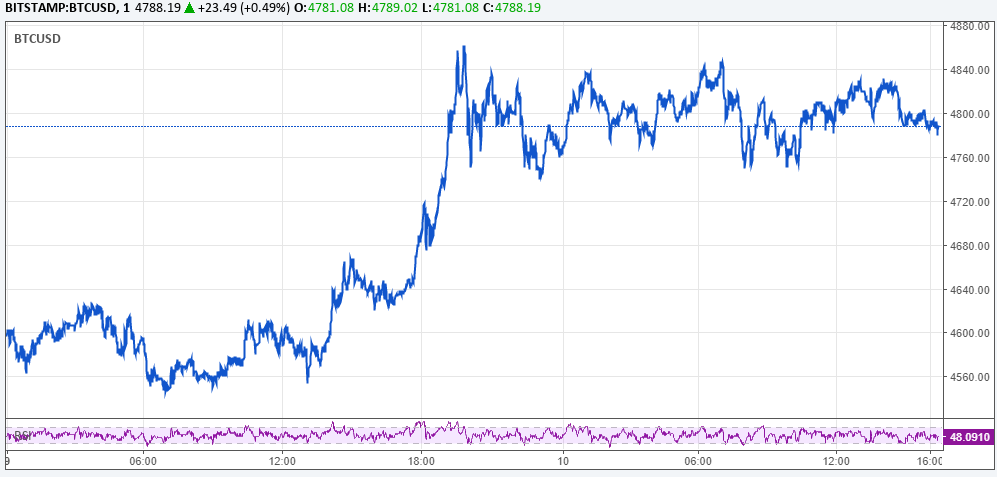

Day Traders will try to capture Bitcoin’s daily price swings and close their positions daily. For many traders, this is a preferred approach as they can manage to make decent profits without the risk of being caught in an overnight price retrace or even a flash crash.

A mastery of price support and resistance levels, discipline and closely monitoring the price is key when it comes to how to day trade bitcoin successfully. Day traders can also initiate long or short positions and benefit from upwards and downwards movements.

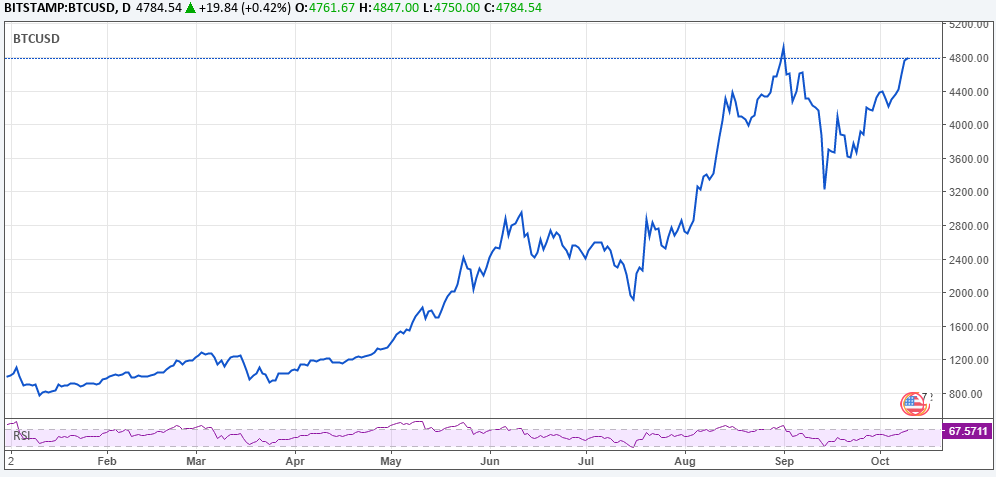

The daily Bitcoin Chart below shows clearly how Bitcoin’s Price can be very volatile and if traders have a good strategy, they can score very decent returns.

Gold Trading approach

The trading approaches mentioned above for Bitcoin could be applicable for Gold with the major difference being that Gold price doesn’t offer as many sharp price movements for day or swing traders.

As for the investing approach, it has been traditional way to invest in gold for centuries. Gold is also used as a hedge for some investors in case of political uncertainties, risk of a market crash of inflation.

Gold responds to different triggers and catalysts although some analysts are starting to say that both Gold and Bitcoin are starting to be correlated.

Unlike Bitcoin, Gold can be traded using multiple vehicles currently not available for Bitcoin. These vehicles range between the physical metal, certificates, ETFs, leveraged exposures such as gold miners and Gold miner’s ETFs and many more.

To trade Gold or Bitcoin successfully, traders have access to competitive swap rates, margin trading and are able to trade both Gold and Bitcoin 24 / 7. They can also initiate long and short positions on Gold and Cryptocurrency pairs including Bitcoin.

Find a Home-Based Business to Start-Up >>> Hundreds of Business Listings.