How to Compete with the Big Guys on Your Terms

If you decide to go after contracts with Fortune 500 companies or government agencies, at some point, you’re going to be asked for your Dunn & Bradstreet number. D&B is the primary business credit reporting company in the United States – like an Experian or Equifax for the world of commerce.

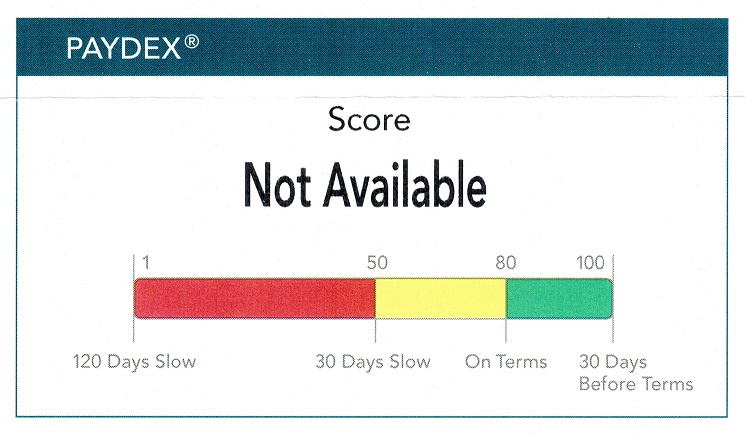

But as a small company, you may not qualify to be rated for D&B’s credit score – the so-called PAYDEX. And if you don’t qualify for a PAYDEX, you can’t compete with the big guys in order to become a bigger company that will qualify.

It’s a seeming Catch-22. But there is a way out, and it will save you thousands of dollars and dozens of hours of effort.

When two prospective customers told me this year that they could not do business with my company due to my D&B report, it didn’t make sense. My company had never been late on a payment to a vendor. Two major banks had extended credit to us worth about half of our average annual revenue. As a contractor, we had never delayed a project due to cash flow or for any other reason. We had never even had to ask for progress payments. In fact, we had always kept an average bank account balance equal to the average dollar value of our projects. We were small but financially mighty.

And yet our D&B report said:

- PAYDEX: Not Available

- Delinquency Predictor: Moderate

- Financial Stress: Moderate to High

- Supplier Evaluation Risk Rating: Moderate

How could the nation’s primary business credit reporting agency be so far off the mark?

Getting the answer to that question took every bit of skill I had gained during my first career as a newspaper reporter, editor and publisher. D&B does not easily give up information on how it comes up with its ratings. But it was worth the research, because I learned that D&B’s system simply does not have the capacity to accurately rate many small companies. That discovery prompted me to develop a work-around that has been very effective so far.

Here’s what you need to know to decide whether you should try to get rated through D&B, and if you can’t get rated accurately, what to do instead.

To have D&B accurately reflect your company’s financial strength, you must have at least three vendors that meet all seven of the following criteria:

- They have extended you credit.

- They supply you with a substantial amount of goods or services on an ongoing basis. (Things like your accountant charging you once a year to prepare your tax return won’t help. Insurance providers also don’t count.)

- They have sold you goods or services on credit within the last 12 months.

- They qualify to get rated by D&B.

- They have a good credit rating with D&B (which means they probably pay D&B $1,399 every year for its “CreditBuilder Plus” program).

- They keep their contact information with D&B current.

- They take the time to answer D&B’s request for information about you.

If you have credit with numerous vendors that you use on a regular basis, then it’s probably worth the effort to call them until you have found a dozen that meet the above criteria, and ask them to please respond when D&B contacts them. Some large companies automatically report to D&B; if they do, ask them to put you on their auto-report list. Then simply go to dandb.com, sign up, and list those 12 as credit references. D&B is likely to get responses from at least three of them, and then you’ll be assigned a PAYDEX score.

You can pay for D&B’s credit-checking service on a monthly basis. But if you read the online discussion boards about D&B, you’ll probably decide to subscribe to the annual CreditBuilder Plus program on an ongoing basis so that your score stays high year after year.

I tried D&B’s pay-to-get-rated system for six months. When it didn’t help our ratings, I began researching what I could do to better provide the information D&B needed. That’s when I discovered that the rating system is unable to accommodate some small or specialized businesses.

The salesman at D&B had no idea how his company determined ratings and could only advise that I purchase the credit building program again, but this time for a full year. The D&B customer service representative couldn’t believe we didn’t have more than three vendors that we purchased from on credit, and he sent a list of all the types of vendors that could be used. The list included cleaning services, collection companies, direct mail services, freight services, furniture rental companies, landscapers, payroll services, software developers, temp agencies, warehouse rentals and water delivery services.

If you’re a small company that keeps your operations simple and does as much as it can in house, you might not use these services, and even if you do, you might pay with a credit card. Paying credit card bills doesn’t count with D&B.

I really wanted to go through D&B’s rating system. I didn’t mind spending the time or money, because it would open up a world of new customers. But after looking through our last 18 months of purchases to identify at least three vendors that might meet the seven criteria, I realized that no amount of time or money would allow us to get rated.

My company’s work entails travelling all over the country to do energy audits on commercial and institutional buildings. Airline tickets, rental cars and hotels are paid via credit card, but D&B does not allow bank references.

When my company is hired to do a construction project on the buildings audited, we typically hire one of our three regular subcontractors. These subcontracting firms were not signed up with D&B, so we could not use them as credit references. For the occasional in-house project, we’ve established credit with three suppliers that provide 99 percent of our construction materials. But we had purchased from only two of those suppliers during the last 12 months.

That was the spoiler. No matter what, my company would not qualify for a rating. We simply did not have three vendors who met all seven criteria.

We were locked out. We had a perfect credit record during nine years of business, zero debt and a healthy bank account balance, and yet potential new customers—including the federal government—would not consider hiring us due to inaccurate data from D&B.

So I came up with a work-around, and so far, it’s worked. It was free and only took a couple hours of time.

Here’s what I recommend you try if you have an excellent credit history but can’t get an accurate D&B rating:

- Call the banks with which you do business and ask for reference letters with as much detail as possible, including the amount of credit extended to your company and your average checking account balance. (Bank of America’s corporate office will no longer provide credit reference letters, but if you know your local branch manager, you might be able to get one.)

- Call your vendors and ask for letters saying how long you’ve been a customer and that you have always paid within terms. One of my vendors included “average days to pay” in the letter. If you typically pay your bills within a week or two after you receive them, this detail helps.

- Write a cover letter that explains that D&B is unable to determine a rating for a company such as yours, and that you therefore do not have a D&B file or do not keep it current. Say that in lieu of a D&B rating, you are providing credit letters from every bank and vendor that has extended credit to your company. To address your potential customer’s concerns about your company’s overall financial strength, you may want to add a final sentence that briefly describes your history of performance. My letter said that we had completed every one of our projects on schedule, with no delays due to cash flow.

When you’re done with that, take the time to write your Congressman. When a private, for-profit credit reporting agency used by the federal government is preventing well-qualified, well-funded, highly credit-worthy small businesses from competing with the big guys, it’s an issue worthy of public debate.

Find a Home-Based Business to Start-Up >>> Hundreds of Business Listings.