As a small business owner, the benefits you offer your employees are an important part of your operating costs. Even if your organization is not able to offer a complete health insurance package, you are still required to participate in some employee benefit programs. Depending on the size of your company, your investment amount may vary. Here are the most common benefits that many businesses must provide to employees.

Social Security

The first benefit that all employers must provide to workers is social security. Any employee that is on your payroll is responsible for paying social security taxes, and the employer must equally contribute as well. When running your payroll, you must withhold the amount of money that goes to this federally mandated program. In addition to funding social security, the money withheld from paychecks is also used to fund the Medicare program. Once employees retire and reach the age of 65, they can start receiving social security and Medicare benefits.

Workers’ Compensation

Next, employers must also participate in a workers’ compensation program. This program is available to a worker if he or she gets injured on the job and needs medical care or income if unable to work. Each state has its own workers’ compensation board, which helps set the rates for employer coverage. Additionally, a small business may seek workers’ compensation coverage through a private business insurance company.

Unemployment Benefits

In some states, companies are also required to enroll in unemployment insurance programs. Small businesses that pay unemployment insurance usually must contribute to this fund via a state tax. Employees can take advantage of this benefit if they find themselves laid off or fired from your company. They simply file for unemployment benefits and receive a portion of their salary until they find new work. In some cases, your current employees can file for unemployment if their hours are reduced and their wages have dropped significantly.

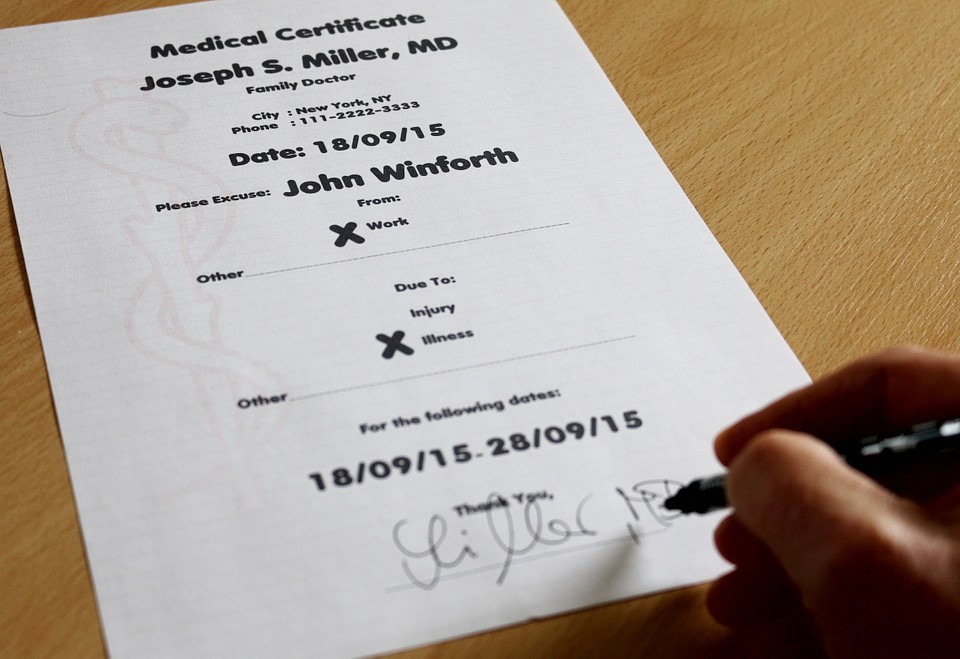

Another type of benefit that many employers are responsible for is family and medical leave. Since the passing of the Family and Medical Leave Act, businesses that employ more than 50 workers must participate in this program. It requires an employer to provide up to 12 weeks of unpaid leave per calendar year for full-time employees when they have a baby, adopt a child, or must care for a family member. If your small business needs guidance on how to prepare for this, it’s important to find an employee benefits consultant with experience in this arena.

Disability Requirements

The last type of benefit that you may need to provide is disability coverage. This is not a federally mandated program, so many businesses in the country may not be required to invest in disability insurance. In some states across the country, employers must pay disabled workers partial wages for a short period of time. States like California, New York, New Jersey, Hawaii, and Rhode Island all have disability coverage requirements for businesses.

When you are evaluating your costs as a small business, be sure to include required benefits coverage payments for various programs that are mandated by federal law or your state. Depending on the size of your business and your location, your participation may vary.

Find a Home-Based Business to Start-Up >>> Hundreds of Business Listings.