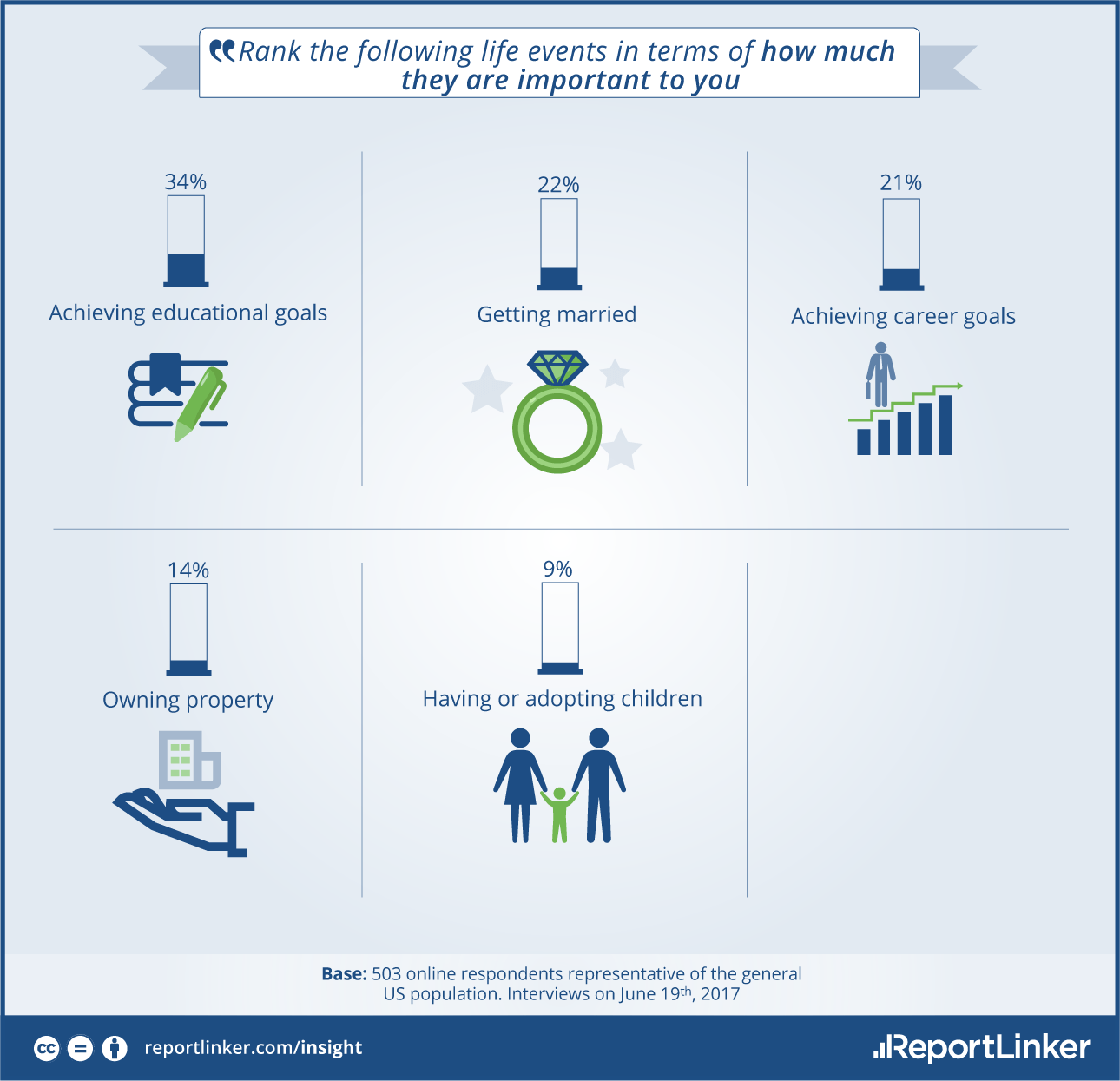

According to newly published research from ReportLinker, while US adults still view home ownership as something important, only 14% in 2017 see it as their “lifetime dream”, which is down even from the mere 19% response of the previous year. These days, Americans place education first, achieving career objectives second, and getting married third. Becoming a homeowner is now fourth on the American list of life’s priorities.

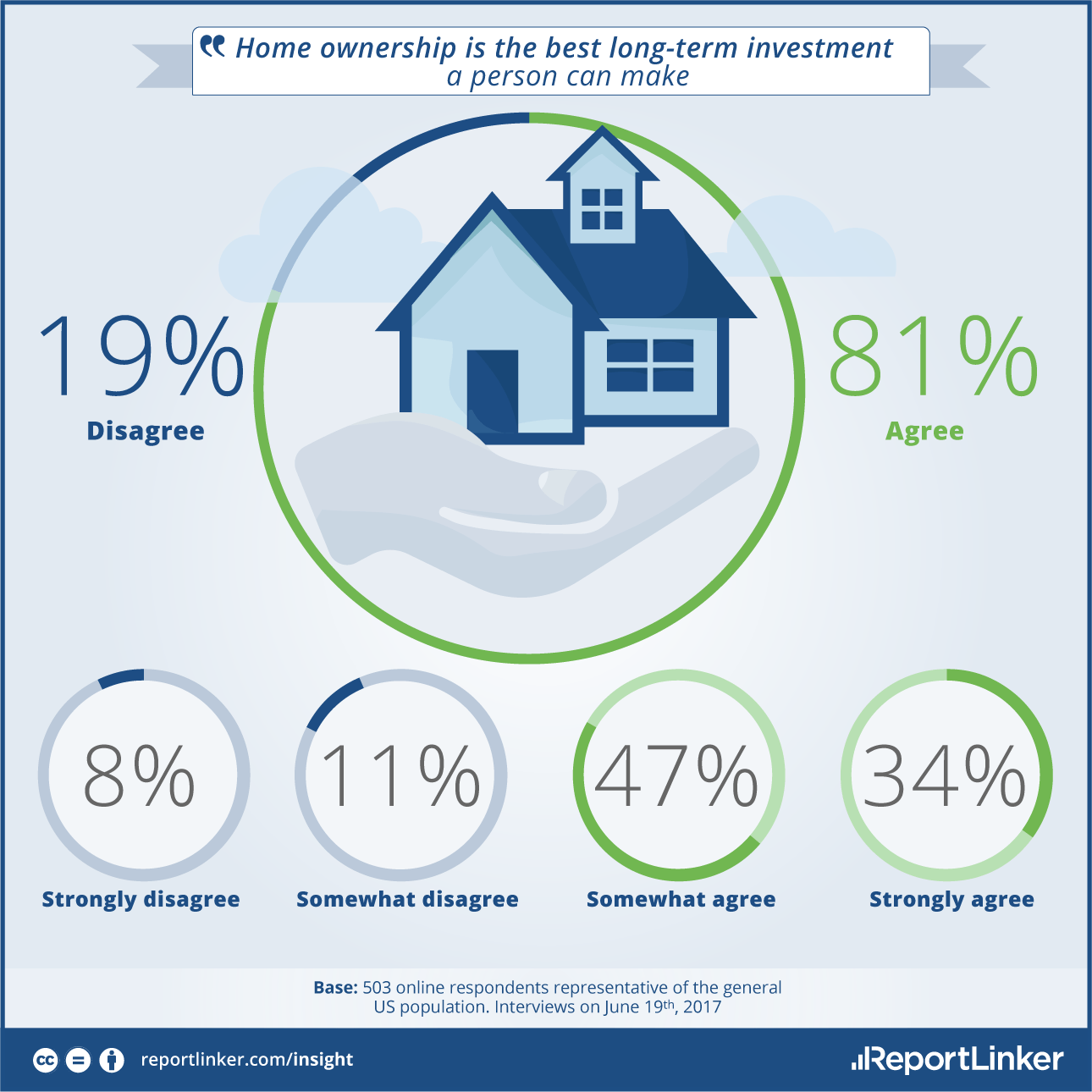

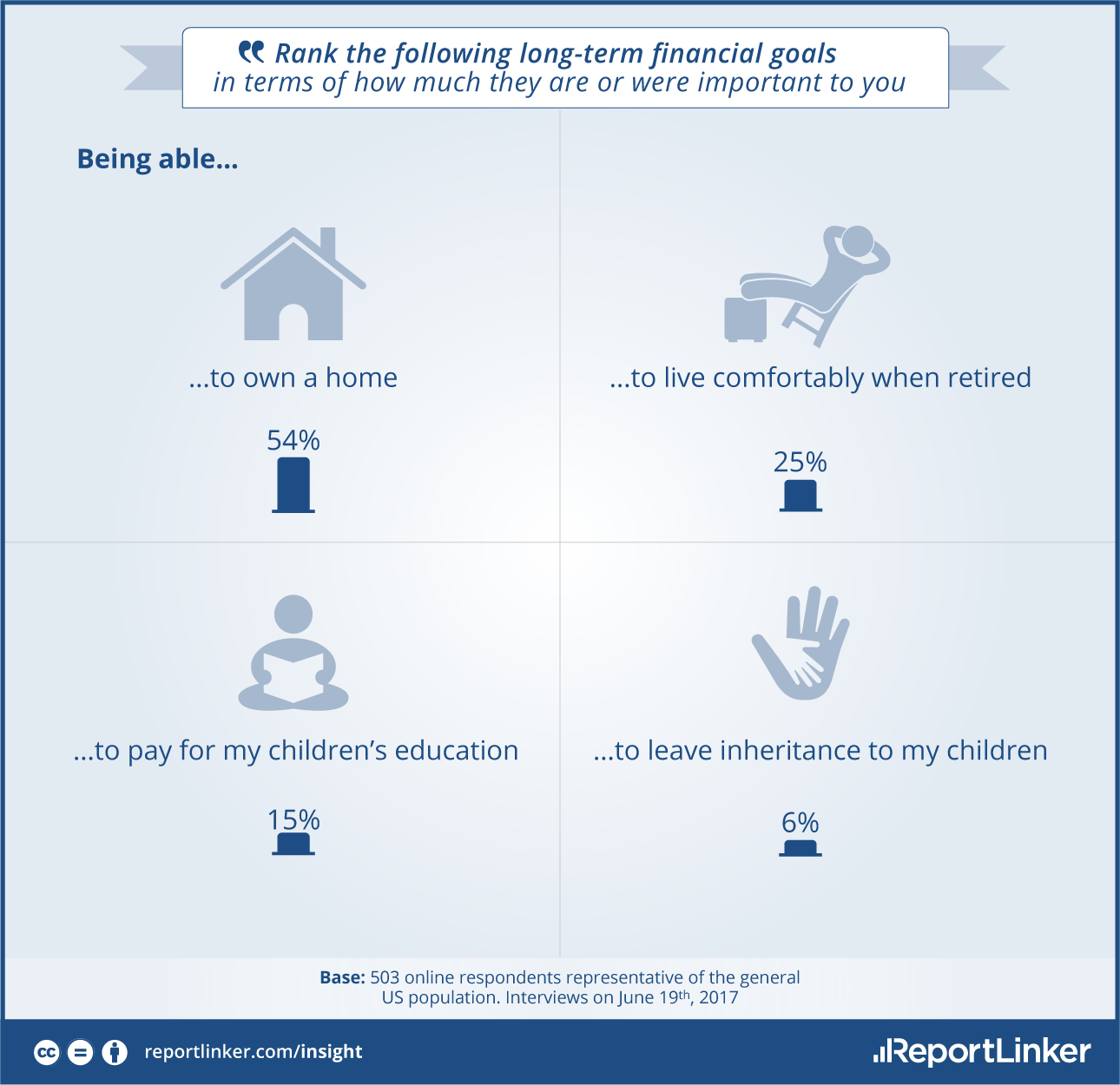

Nevertheless, in spite of the stricter credit standards imposed by lenders since 2008, 54% of US respondents still deem home ownership the greatest of long-term financial objectives. In fact, 81% believe that buying a home is the greatest of all long-term financial investments. Millennials, too, are now getting more interested in buying and less interested in renting a home.

However, there is an obstacle to first-time home buyers in the form of a US housing shortage. The shortage has been instigated, largely, by the Millennials’ desire to live in the city, with all of its closeby attractions and amenities in addition to short work commutes. Consequently, builders have been focused on putting up higher-priced urban buildings while the less-expensive suburban housing has been largely ignored, such that competition for living in urban spaces has gotten fierce.

The good news is that builders are now moving a lot of their operations into developing the exurbs. This market is made possible by the aging of Millennials who, while still quite young, want to get married and possibly have children while they’re now earning enough money to get serious about investing in their future. What’s more, huge, nationwide home builders like Toll Brothers are building homes to be sold at lower price points to capture some of the Millennial first-time-buyer market. Also trending upward now with builders are town houses, and smaller homes built on smaller properties.

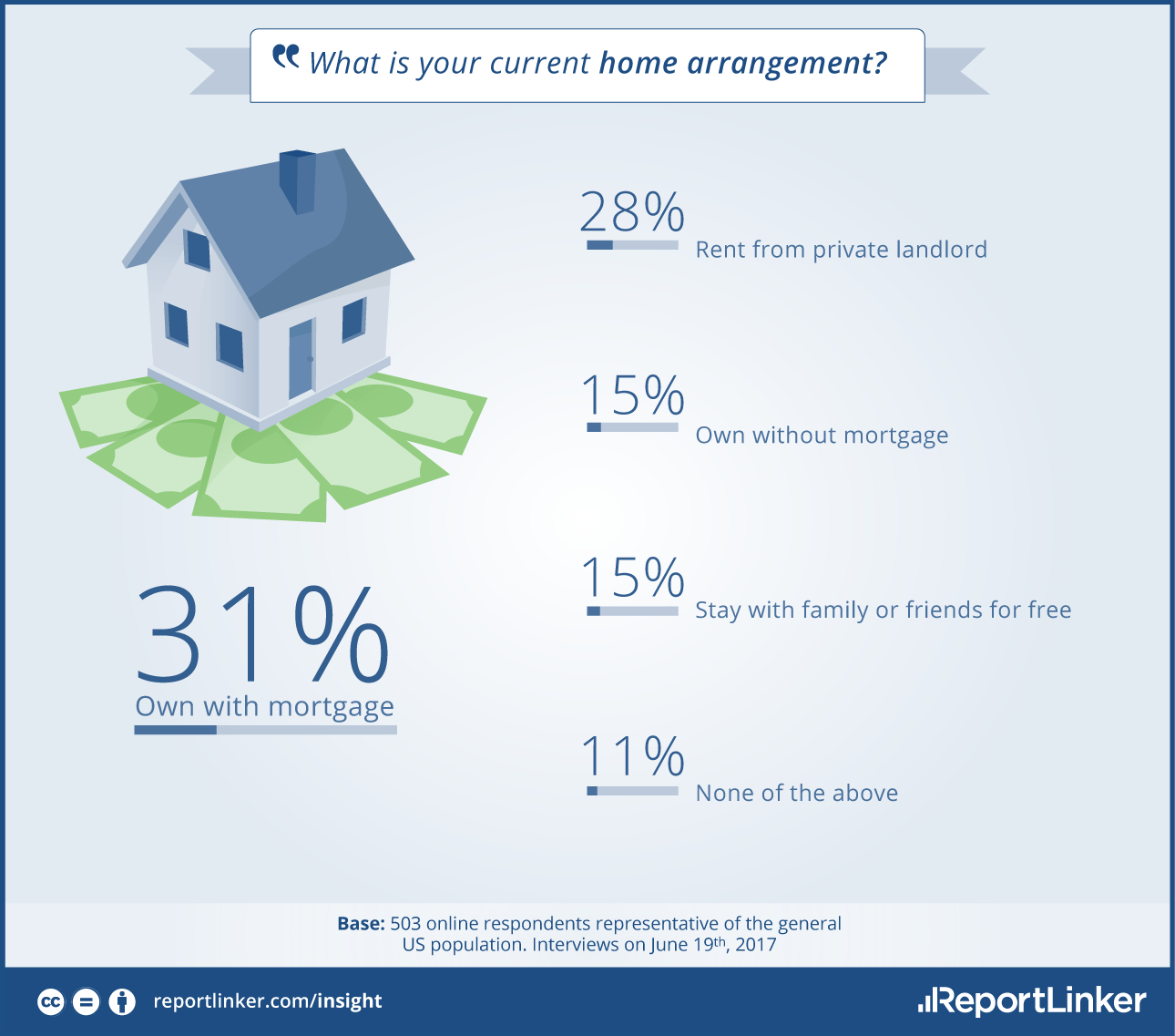

When it comes to homeowners, 15% own their house outright, while 31% carry mortgage debt. Those who are aged 55 and older are most likely to be free of a mortgage (36%). Half of those in the 35 to 44 age range are still paying off a mortgage.

More than one-fourth of respondents are renting. Renting is popular with those aged 25 to 34 (44%). Meanwhile, the youngest Millennials (18 to 23) respond that they’re currently living at home or “couch surfing”. Those Millennials are very likely to still be students who aren’t working enough hours at high enough wages for living independently.

A renting trend catered to by such companies as HubHaus which is gaining huge popularity now among working, urban Millennials is “co-living”. This communal approach to renting takes the social element into account while saving the renters time and money.

Returning to homeowners, the great majority say their home is just the right size (70%). But 18% say their house is too small while 10% would like to downsize.

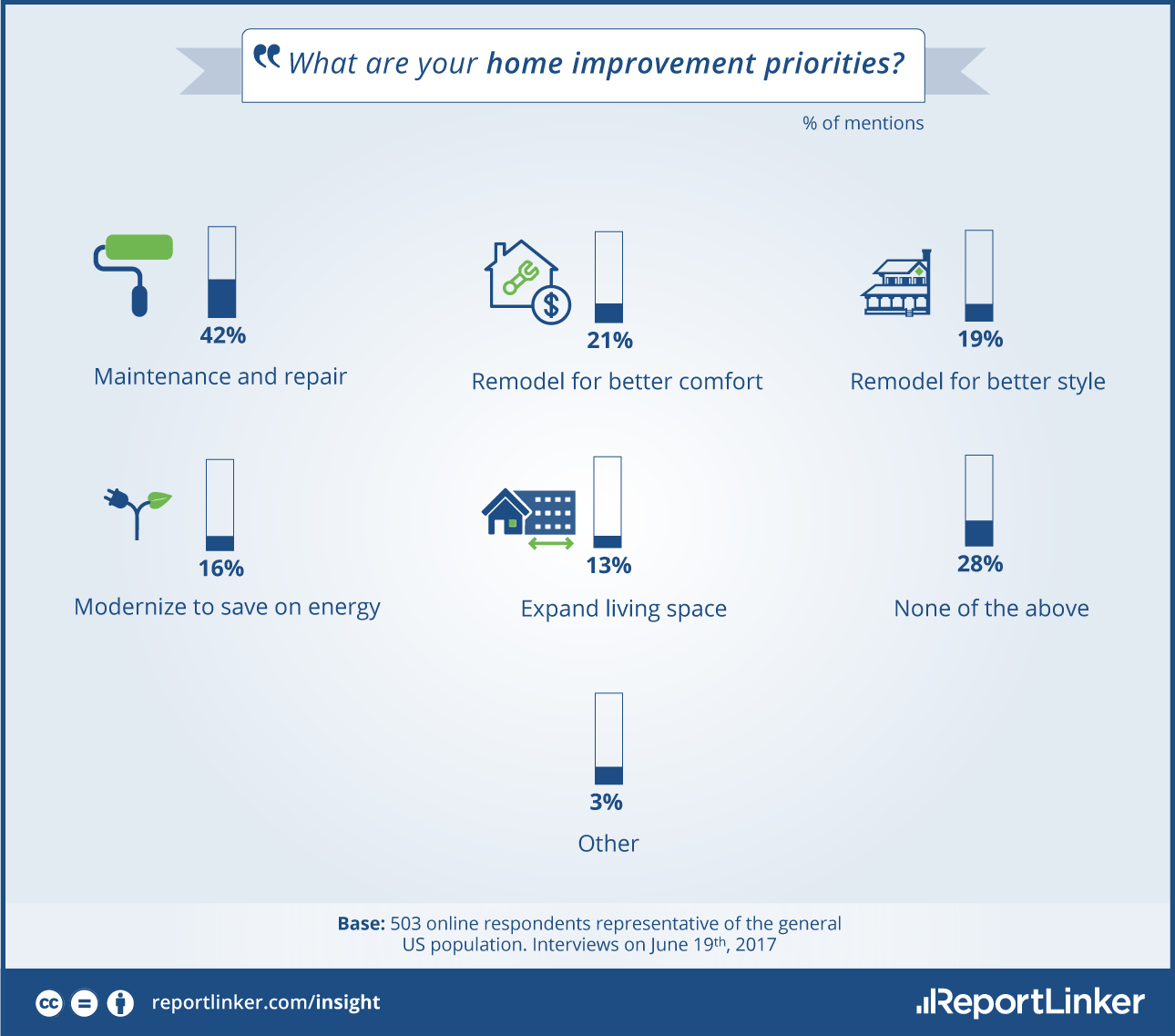

Beyond the consideration of living space is home maintenance. Those homeowners aged 35 and older list home repairs or maintenance as their number one “to-do” priority (45%).

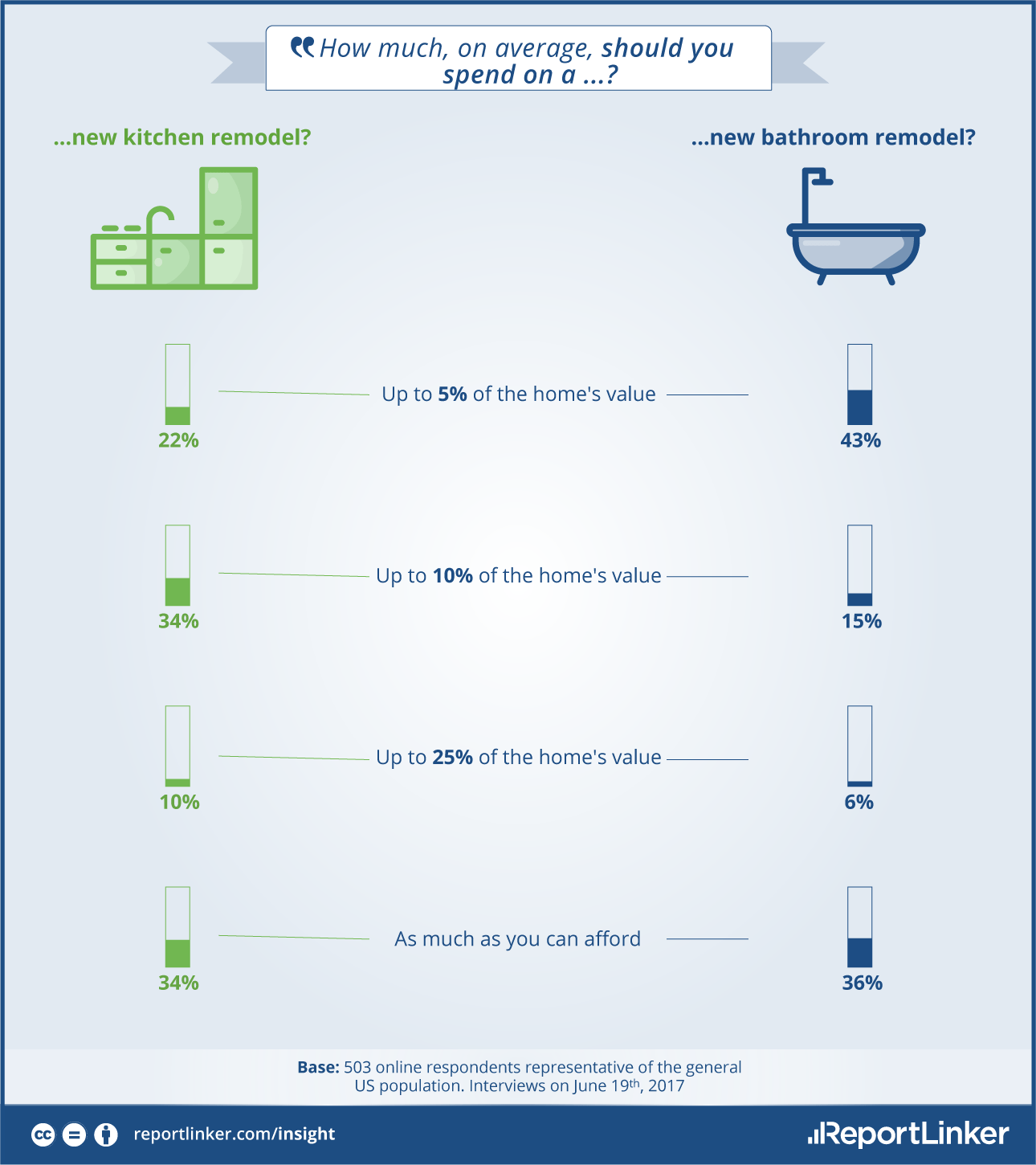

Those rooms that are most-targeted for remodeling or upgrading are the kitchen and bathroom(s). While many homeowners have strict budget constraints in these areas, one-third would spend up to whatever they can possibly afford to remodel kitchen or bath. In fact, more than 40% of women would spend whatever they possibly could to upgrade their kitchen. Yet, it’s the basic maintenance tasks, such as repairing a leaky roof, that typically pay off the most, especially if the home gets put up for sale.

And with more and more Millennials looking to buy homes, it’s a seller’s market in US real estate.

Find a Home-Based Business to Start-Up >>> Hundreds of Business Listings.