Will Bitcoin survive and become a viable payment option in ecommerce? And, more importantly, should you accept cryptocurrencies in your store right now?

Cryptocurrencies. How do you deal with these magic Internet money? Grab, wait, or bail? Are they a fad? Should you accept them as a valid payment option? If yes, how do you do that? What are the risks of accepting a poorly regulated currency? What about volatility?

We take a look at Bitcoin – as the biggest cryptocurrency with 52% of market cap – as well as ecommerce and the risks and benefits these crypto tokens carry with them.

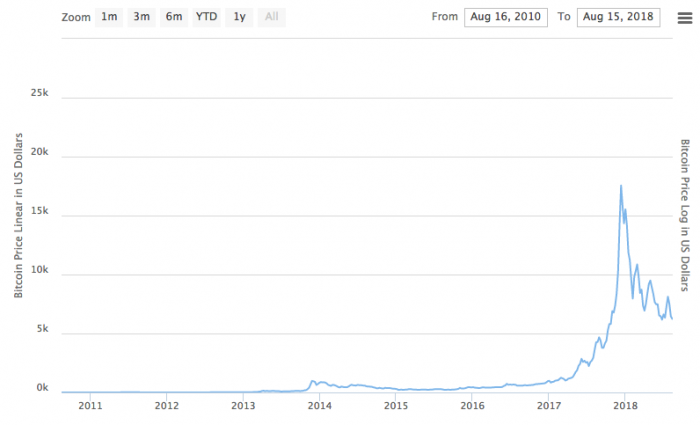

Hasn’t Bitcoin, Like, Crashed or Something?

Yes, it did. Pretty hard. Within a year Bitcoin went from $17,000 to $6,500. Just look at the chart.

What a trap! You should be glad you decided to stay out and didn’t invest when it was on the rise.

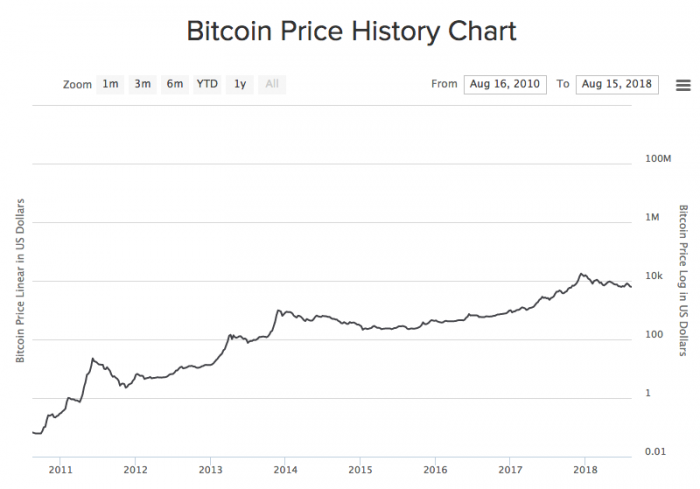

Here’s another chart. Well, technically, it’s the same chart from the same page. But it tells a different story.

This chart looks better, right?

OK. So Bitcoin is not worthless. It has a future. We’ve established that. Now let’s see what’s possible future of crypto payments for ecommerce. Who boycotts Bitcoin and who accepts it?

Bitcoin Versus the World

Bitcoin was introduced in January 2009. This means it’s 9 years old. Nevertheless, despite a huge amount of alternative coins and talks around the cryptocoin phenomenon the financial world still looks at crypto with distrust.

Some see it as a speculative asset, others as money for scammers and mafia (yep, that’s what Bill Harris, the founding CEO of PayPal, thinks and writes about).

Weakness #1. Volatility

Bitcoin as well as other coins is highly volatile. During these 9 years it’s been all over the place. From mere cents to tens of thousands of dollars.

At the time of writing this article the price of Bitcoin fluctuated within a $200 range. This is huge compared to fiat currencies that only change within a tiny range or get shook up only following groundbreaking political events.

High volatility means Bitcoin is unpredictable.

Weakness #2. Poor Regulation

Bitcoin is a speculative asset. Bitcoin is a currency. Bitcoin is “money for crooks”. Bitcoin is all these things and none of them depending on which country’s law book you are holding right now.

Lack of regulation means Bitcoin and other crypto coins are most of the time located in the grey area of the law. Some of the main issues with Bitcoin lie in its inability to fully comply with Know Your Customer / Money Laundering laws because of the anonymous nature of most transactions. Its popularity with Silk Road-type services has also done huge damage to its image as a legitimate payment option.

Lack of laws means Bitcoin is unregulated.

Weakness #3. Low Security

Over the years Bitcoin holders and crypto exchange platforms have been suffering from cyber attacks, security issues, and outright theft. These are not separate incidents. Hackers specifically target computers and servers all over the world to mine and steal cryptocurrencies.

Because of the decentralized nature of crypto the wallet is not exactly located in the cloud. It resides on the hard drive of a specific local machine and can be accidentally deleted, hacked, or lost just as you can lose anything on your computer. Either due to your negligence or a hardware failure.

Yes, people do that. Here’s a story about James Howells who dumped a hard drive with a Bitcoin wallet worth $80 million dollars.

Bitcoin exchanges have also become targets of hacks and robberies, suffering hundreds of millions of dollars in damages.

Lack of established best practices in crypto handling means Bitcoin can be insecure.

Three Strengths of Cryptocurrencies

Worldwide, each transaction through PayPal costs 3.9% of transaction amount plus a fixed fee based on currency. These expenses are always on the side of the merchant and directly affect the merchant’s bottom line.

Let’s take a look at crypto payments now.

Strength #1. No Transaction Fees

On the other hand, cryptocurrencies offer a wide range of processing fees. From completely free to quite pricey. So why do we list it as a strength? First of all, because the merchant is not the one absorbing these costs. The buyer is responsible for the entirety of the transaction. This also includes choosing how much reward they put aside for blockchain users to process their transaction faster.

Since in most cryptocurrencies shoppers have to outbid other shoppers to determine whose transaction goes through first, supply and demand form current fees.

We should note that Bitcoin, among other cryptocurrencies, has earned a reputation of one of the priciest platforms for transactions. But it’s only partially true. Right now, in August 2018, the price to process your transaction within 10 minutes is only 11 cents.

And this is the entire fee. It doesn’t matter what amount of Bitcoin you move. In stark contrast to PayPal, the fee will be the same both for BTC worth $50 and $50 million.

So, cryptocurrencies are free to use for merchants and cheap for customers.

Strength #2. All Transactions Are Final

Once you send someone coins you cannot get them back. This means there is no way for the customer to scam you falsely claiming they haven’t received the product or that the product was not of sufficient quality.

PayPal is well-known for siding with the buyer which strips the merchant from any protection from such frauds. Common banks also allow users to abuse bank chargeback mechanics in customers’ favor. With crypto, all your transactions are final and undisputed.

This is of course a double-edged sword since the blockchain removes one of the most important buyer’s protections – chargebacks. Paying for something in cryptocurrency means you need to trust the store to deliver.

With crypto, all transactions are irreversible and final, no matter what.

Strength #3. Offering More Payment Options Boosts Sales

Well this one is easy. Opening more opportunities for the customers to pay for your services is always a good thing. And even though you might be in doubt whether to use a completely new payment method, it’s never late to try.

Now you can accept cryptocurrencies at your store without creating a BTC wallet or worrying about payment processing. Crypto payments can be auto-converted to fiat money on the spot.

To negate the flaws of Bitcoin and other crypto coins and still offer crypto payments to their customers, merchants can automatically convert all crypto payments to fiat money with the help of a third-party integration.

CopPay offers a Magento 2 gateway integration that helps merchants eliminate major drawbacks of working with coins. It brings the benefits of accepting cryptocurrencies in the store while removing all risks of dealing with crypto payments from the merchant to the platform. Customers pay in crypto and stores receive fiat money to their bank accounts.

Cryptocurrencies can be integrated into online stores indirectly.

What Is the Future of Crypto Payments in Ecommerce?

When you’ve dealt with other traditional payment gateways for years, you start to appreciate the chance of using cryptocurrencies as a payment option.

Most conventional payment systems shift processing fees towards the seller. PayPal is the most prominent example but other systems such as Stripe or Amazon Payments aren’t better in this regard.

Cryptocurrencies are slowly making their way into conventional ecommerce stores. Some business owners cheer at the opportunity to add a new payment method to their stores. Others are wary of the uncertainty of the legal requirements, their changing nature, accounting issues, and technical challenges.

While the ecommerce community is divided we recommend to closely study the option of accepting crypto in your own store.

1. Cryptocurrencies as an alternative to PayPal. PayPal charges exorbitant fees which is especially painful for smaller businesses that are more sensitive to competition, price changes, and generally rely on fewer sales and fewer customers to stay afloat. The alternative to PayPal in this situation is CC and crypto. Accepting credit cards isn’t free either. They also ask money for transactions and chargebacks.

2. Magic Internet money or the real deal? Crypto is not the killer of fiat money. Neither it will dominate the market. But we strongly believe that with time cryptocurrencies will change the way we see digital transactions in ecommerce and what’s good and what’s unacceptable in terms of rates, security, and anonymity.

3. Will high volatility kill crypto? Our understanding is that crypto is still interesting and exciting for businesses and consumers alike. The partial drop of Bitcoin exchange rates can be temporary. It can be permanent. We don’t know yet. What we do know is that people are still mining and using coins. Which means they want more places where they can spend their shiny Internet money.

4. The benefits of actually bothering. Cryptocurrencies are not straightforward right now. Their regulation is extremely different in different countries where some states recognize them as money and others as assets. But while crypto can be tricky to deal with, ecommerce owners don’t need neither the technological know-how nor special training to integrate crypto payments into their stores. Development of crypto payment gateways is going at full speed with Shopify, WooCommerce, and Magento communities adopting crypto tokens as the newest payment option for online stores.

Find a Home-Based Business to Start-Up >>> Hundreds of Business Listings.