The latest figures from the Office of National Statistics (ONS) show the sectors struggling to survive due to impacts of coronavirus. Trading and turnover figures show the number of businesses unable to trade currently stands at 17%.

The twice-monthly data update from ONS shows the accommodation and food services industry to have been hardest hit, with 43% of businesses unable to trade, more than double the national average.

Business closures & disruptions to trading

The effects of coronavirus and lockdown have impacted turnover, with 45% of all businesses reporting a decrease in turnover. And, likely due to restrictions imposed on pubs and restaurants, over three-quarters of businesses in the accommodation and food service industry reported a drop in their usual takings for this time of year.

For 38% of businesses, though, turnover has remained the same as pre-COVID levels.

Across the board, 3% of companies permanently ceased trading in the first two weeks of December, and 5% expect to temporarily or permanently close a business site in the next two weeks.

Micro businesses with nine or less employees have been hardest hit, with 17% reporting that they’re unable to trade due to the impacts of COVID-19.

The costs of business supplies have risen in some cases, with 15% of businesses reporting that prices have crept up since the pandemic. This shows that the disruption caused by the pandemic is affecting supply chains and profit margins.

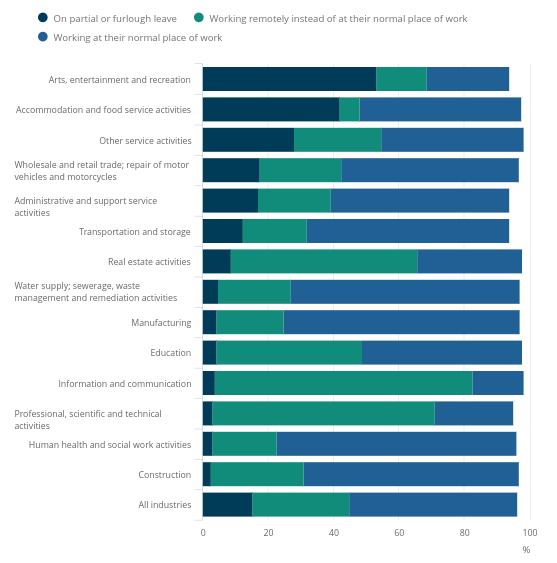

Workforce on furlough

Current furlough figures show that 16% of the UK workforce are currently on furlough, which has doubled since October.

According to the survey, the hospitality industry can expect to see 39% of staff returning to the workplace. However, changing rules on visiting pubs and restaurants may affect this. Though in other sectors, significantly less staff are expected to be back to work normality, leaving furlough schemes and homeworking in place.

Office closures

According to Savill’s, the nation-wide lockdown in Q2 of this year saw many offices temporarily shut down, with some companies opting to keep employees working from home for the foreseeable future.

The number of office spaces left empty will have been further compounded by Government advice to ‘work from home if you can effectively do so’ in England, encouraging a shift to remote working for office workers.

There is evidence in London of empty office hotspots. Savill’s found a dramatic 50% decrease in office space uptake in The City of London alone.

With office space not in usual use, the need for commercial cleaners and catering staff has dropped causing major effects on such businesses.

Perfect Clean, Scotland based cleaning service providers, have examined the latest figures to find that 25% of businesses within the Administrative and Support Services sector, which accounts for cleaning companies, have temporarily or permanently ceased trading.

Additional effects from coronavirus have seen 3% of businesses cease trading in the first two weeks of December in the sector, whilst 9% of businesses in the sector report no or low confidence that their business will survive the next three months.

Signals of recovery

While the impact of the coronavirus pandemic has clearly taken a toll on businesses across the UK, there are signs of recovery. 24% of the workforce are expected to have returned to their usual workplace, either from furlough or remote working.

Savill’s also reports an uptick in office premise demand in London and the South East, signalling that some businesses are intending to return to traditional office spaces in 2021.

Four out of five businesses believe their business will survive the next 3 months.

Find a Home-Based Business to Start-Up >>> Hundreds of Business Listings.