By William Olsen, CPA, Co-Founder of Deductr

If you are a self-employed professional, a freelancer or a small business owner, ask yourself this question, “How much time and effort do I spend making money vs counting it?” If you’re like most of the clients I have had over the years you want to do what you’re good at and get paid for it. After all, isn’t that why you went into business for yourself in the first place?

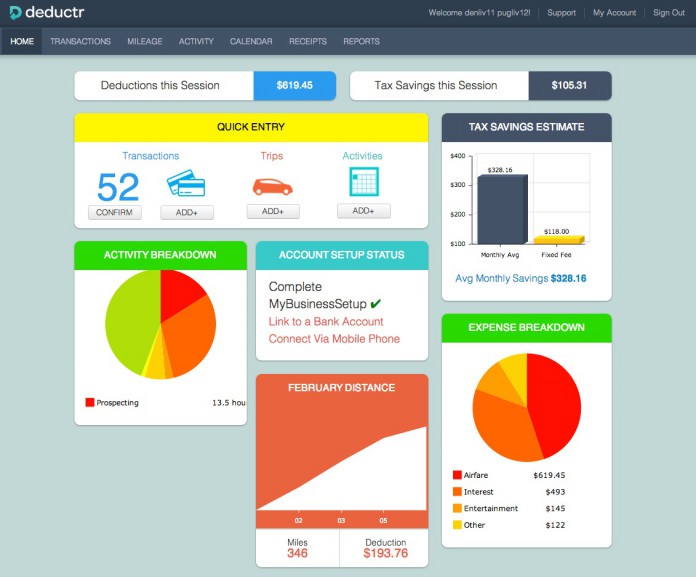

How do you spend less time on your bookwork and still maximize your tax deductions? The answer is Deductr. Through its simple user interface Deductr let’s you track your business related financial transactions, mileage and time all in one place and from anywhere you can be online – including your mobile phone. Deductr captures your information and stores it in the cloud for future reference, including pictures of your receipts.

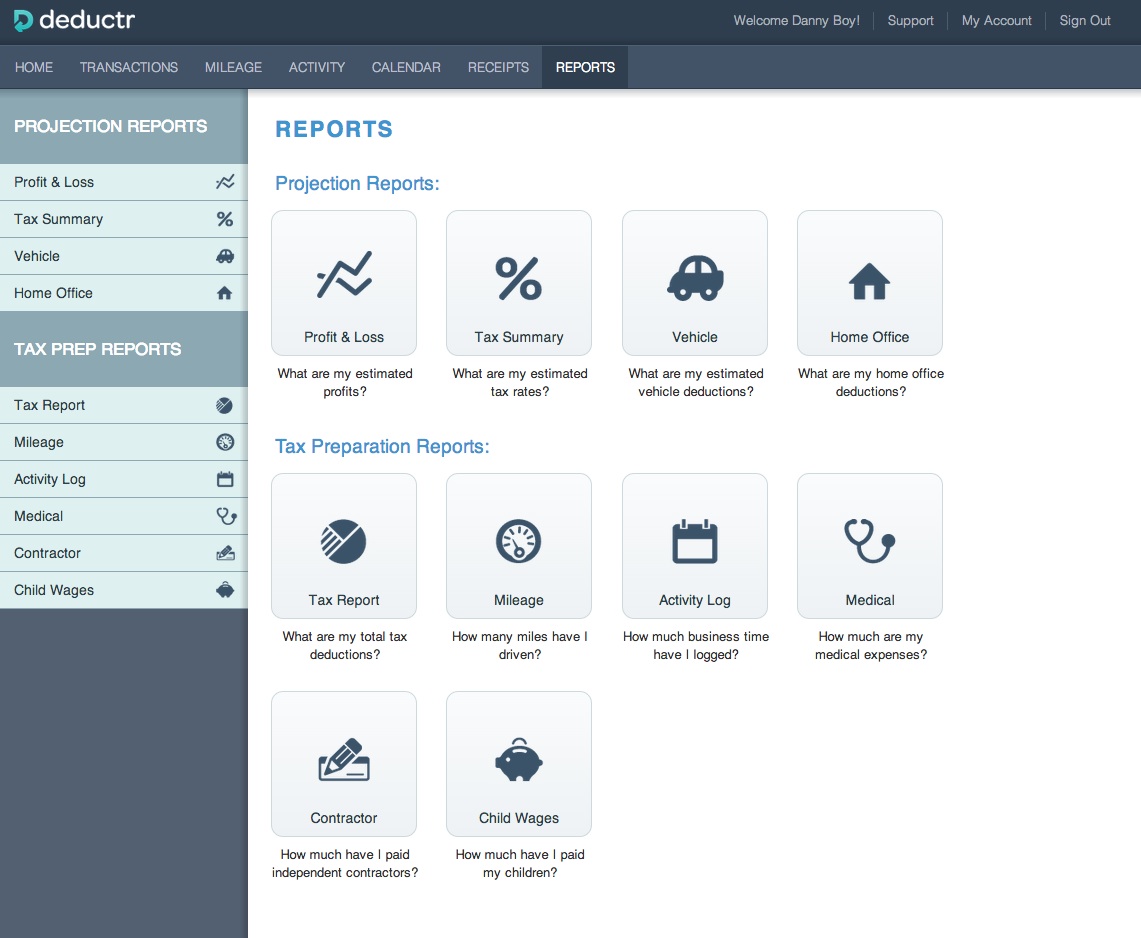

Deductr really comes to life as it processes your information for optimal potential deductions. It goes to work for you to present your information in a way any tax preparer would want to see it. The best part is, you don’t have to wait until year-end to see the results. Deductr is constantly giving you feedback as to how effective your tracking efforts are by showing you your estimated tax savings in real time. Customized to your particular circumstances, it calculates your potential savings based on the deductions you are tracking. Armed with this powerful information, and the peace of mind that your records are up to date, you can focus more on producing income.

Your tax preparer is only as good as the information you provide. That is why he or she is always pressing for more and better records. Give ‘em what they want without having to become your own tax expert to do it – Put Deductr to work for you!

In future articles I will explore the nuances of how Deductr was designed to bring you powerful results and tips and tricks to maximize Deductr’s functionality to make your life easier. 3/14

Find a Home-Based Business to Start-Up >>> Hundreds of Business Listings.