The world of banking as people know it today is dramatically changed from prior years. Virtually every aspect of banking, whether making payments, checking balances, transferring money, or applying for a loan is completely revolutionized thanks to the internet. Instead of handling transactions in person, people mainly now use online solutions.

Considering how much and how quickly things have transpired, there is no question that the near future has even more innovative changes in store.

To meet the ever-changing demands of online customers and retailers, fintech solutions will continue to evolve. Already, a large number of carefully planned strategies have been implemented to create a more robust online payment and banking solution. However, there are even more changes predicted for this industry. The following information provides insight into what consumers, retailers, and other online business owners can expect in the near future.

Enhanced Mobile Payments

Mobile payments have had a huge impact on both online payments and banking. A perfect example of this is with a recently launched program by MasterCard. Instead of entering a password to gain access to an account, consumers scan their face and use selfies.

As if this biometric authentication app is not unique enough, MasterCard confirmed it is currently testing additional options, such as cardiac rhythm, voice recognition, and facial identification. For consumers and merchants, there are three goals for enhancing mobile payments. First, make payments more seamless; second, simplify the process of making online payments; and third, provide the highest level of security possible.

Specific to mobile payments, several viable options exist. As an example, a consumer can use a mobile app to make purchases with a specific merchant. Because data are only stored on the user’s device, as opposed to the merchant’s device, the app is completely safe.

Increasing Interest in Mobile Wallets

The introduction of mobile wallets is one of the most significant changes in online payments and banking. From a retailer’s perspective, mobile payments are extremely beneficial. This method of making purchases gives retailers insight into the customer’s behavior. This helps retailers make appropriate modifications that improve the overall shopping experience.

In addition, mobile payments have great potential for increasing the number of consumers that visit a brick-and-mortar store. Because this boosts sales, the company generates more revenue.

In 2014, Apple was the only major mobile wallet available. The following year, other companies launched mobile wallets, including Google and Samsung. Shortly after, additional mobile wallets were launched by Walmart, Amazon, Chase, and a number of other key players. Even various social media platforms, including Facebook, now have online payment options, whether sending money to family members and friends or making online purchases.

Experts that have closely monitored changes to both online payments and banking anticipate that by 2020, the volume of in-store mobile payments will reach $500 billion.

Especially for online payments coming from mobile devices, the potential for growth is staggering. Experts also predict that of all transactions by 2025, 75 percent will be completed without cash. This clearly indicates that consumers feel more comfortable with and confident in using cards and smart devices over carrying actual money.

Digital Remittances on the Rise

Since the introduction of digital remittances, sending money to other places around the globe has become easier. With increasing interest, the number of digital startups has skyrocketed. In 2001, Xoom was founded. Based in San Francisco, California, this company has experienced substantial growth specific to digital remittances. Today, the amount of revenue generated outreaches MoneyGram.

Peer-to-Peer Lending Experiencing Growth

Another area that has seen a tremendous amount of growth in the past several years is peer-to-peer lending. By making these transactions possible, consumers have another option outside of traditional lenders. Consumers also pay less interest than with a conventional lender.

There are a number of innovators involved with peer-to-peer lending. One such company is Lending Club, which since being founded has originated more than $20 million in loans.

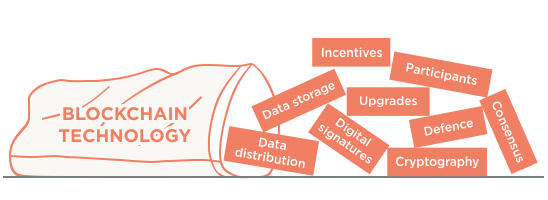

Blockchain Technology

In looking at various indicators, it appears that online payments and banking could be disrupted as cryptocurrency and blockchain technology experience growth. For the most part, people believe that tokenization will be responsible for shaking up the financial industry.

Already, different startups, including Movile, are taking full advantage of the potential that comes with incorporating bitcoin as an alternative mobile payment option as well as for in-game purchases in several developing countries, like Brazil.

Sometime within the near future, blockchain could easily be among the largest disruptors of all. People in support of this technology emphasize that there are more trust and transparency with blockchain. They also stress that this technology streamlines the process of making payments.

New Waves in the Retail Industry

Some big waves are being made in the retail industry by beacons, sensors, and big data. These three things are designed to help merchants reach consumers as well as customize offers. For example, with big data, retailers and merchants have the ability to send out promotions, flash sales, and coupons to a targeted audience. In fact, purchases can be finalized in advance using this technology.

Transfers Using P2P

There are many viable options available for making mobile payments. For instance, transfers are completed using mobile P2P. For these transfers, the consumer’s mobile device makes the bank transfers. PayPal has dominated the payment industry for a long time, but with an increasing number of competitors on the horizon in the form of startups, that could quickly change.

One startup, Ozan.com, serves as an alternative to banks by offering various online banking products. Because this company does not charge transaction fees, it could easily become serious competition for PayPal and others. Another company that offers P2P mobile payments is Venmo.

With the level of today’s innovation so astounding, there are endless options for expanding online payments and banking. Although companies have made great strides for security, this continues to be a major concern. The bottom line is that with transactions being completed so quickly, it is obvious that online banking will continue to evolve.

Find a Home-Based Business to Start-Up >>> Hundreds of Business Listings.