The biggest advantage to self-employment is, predictably, being employed on your own terms. Enjoy a flexible schedule and take the time to do work you’re actually proud of. It’s the dream, but having to find proof of income, self-employed or not, can put the breaks on that freedom. Being self-employed is not for everyone as you have to make sure you are on top of all your income and tax payments. You don’t have an employer to make paystubs for you. It is up to you to keep on track and stay organized.

Although there are finance options like car title loans with no income verification requirements, it’s often necessary to show proof of income for loan, tax law, and insurance purposes. But such verifications escape the daunting world of finances and step into hobbies too. For example, a functioning iGaming account cannot lack some sort of proof of funds, as part of what is known as KYC. Of course, if you’re not a finance master, this may seem like a daunting or impossible task.

Not to worry, though: proving your income is less difficult than you might guess. Follow these four key steps, so you can get started today!

Your Annual Tax Returns

When it comes to proof of income, refunds do and will always come first. For freelancers and business owners, this report should come at the end of the year when you receive your income report.

For the self-employed, however, filing taxes can present a pretty serious disadvantage. As someone who employs themselves, it can be easy to forget or simply neglect to record “off the books” income. As so often happens in these cases, then, your tax returns won’t fully represent your total income for that specific year.

The wage and tax statement for the self-employed, form 1099, proves your wages and taxes as a self-employed person. It’s considered one of the most reliable documents there is, owing to its status as an official legal document.

Bank Statements

Your bank statements are another great answer to the question of “how to make proof of income”. With bank statements, you could easily show you receive reliable income for an auto pawn loan. The danger, however, is in the fact that it is actually quite easy to misidentify certain expenses or deposits.

When we set up separate accounts for business purposes only, we go a long way toward fixing this problem. By cordoning off your expenses in this way, you protect yourself from potential mistakes and slip-ups.

If you have a consistent history of self-employment pay stubs, you can prove a stable income flow on your bank statement. With the use of a pay stub generator, you can make this process even easier. Click here to find out more.

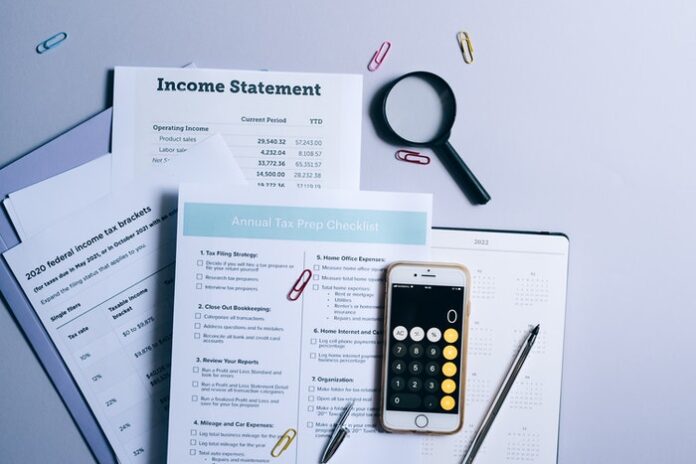

Profit and Loss Statements

If you are a business owner, it is important to document your profits and losses. Self-employed persons, however, can and should prepare these income statements, as well.

Statements must include income, expenses, and all business-related deposits for the year. You’ll also need relevant dates that match your banking statements, whether physical or online. If this process seems a little intimidating, there are credit companies who can help you prepare your statement.

For income statement and ledger documents, this summary can show your lenders your income and proof of self-employment.

There are some great free and paid software options for keeping track of your business finances on Software For Projects.

Where to Get Proof of Income: Self-Employed

Self-employment is one of the most liberating ways to make a living there is. What puts a damper on it, though, is having to prove your income for insurance or other purposes.

Luckily for you, then, showing proof of income, self-employed or not, is much easier than most people think. Having your tax return, income statement and bank statement all in the same place can help you prove your income easily.

For more on how to verify self-employment and other insights into the subtle art of being an entrepreneur, check out our other awesome blogs today!

Find a Home-Based Business to Start-Up >>> Hundreds of Business Listings.