The image of a bootstrapping entrepreneur starting a business at home is an iconic one, and many businesses not only start that way, but stay that way. That was my approach when I started my own home-based business, which I ran for more than a decade. People would often tell me they envied me for what seemed like an easier work life without a clock to punch or managers telling me what to do.

But those of us who have taken that leap know the reality of being self-employed and running a home-based business can be much different. For many home-based businesses, money — including cash flow and financing — are a constant source of stress.

In my business, I often worked on large projects for corporate clients and some were much slower to pay than others. More than once I found myself walking from the mailbox back to the house filled with frustration and disappointment that a check from a key client had not arrived.

When you’re self-employed, your business and personal finances are inexorably linked. In September 2019, Nav surveyed small business owners about the intersection between their personal and small business finances. Of those who responded:

- More than half (56%) were forced to skip a paycheck in the past year.

- Their top 3 personal financial worries were managing debt (75%), saving for retirement (63%), and cutting back on personal or family spending (62%).

For many business owners, those concerns are magnified in these uncertain times.

If there’s anything we’ve learned this year, it’s that you can’t overprepare. And when it comes to financing, one way to do that is to build a foundation for financing before you need it.

In other words: get lender ready. Here are 7 steps to accomplish that:

1. Incorporate

The large majority of small businesses in the U.S. operate without a formal legal structure. It’s easy to start that way, and easy to put off creating a business structure later. But when it comes to financing, it’s crucial to understand that until you create that formal legal structure — LLC or S Corp, for example — there is no legal distinction between you and your business. They will always be closely intertwined.

There may be tax and asset protection benefits to forming your legal structure. When it comes to financing, the benefit is that you will increase your lending options. There are some lenders, for example, who simply won’t lend to an unincorporated business.

2. Stick to a business bank account

Roughly one in five business owners don’t have a business bank account. But if you want to qualify for top-tier financing, you’ll need one. Many lenders will either require business bank statements or will ask you to link your business bank account to verify revenues. And once you do set up that account, use it strictly for business expenses. If you need to pay a personal bill, pay yourself from that account then pay your bills from your personal funds.

3. Use a business credit card

If possible, use a dedicated credit card just for business purchases. A small business credit card can be ideal, but if you can’t qualify for one right now consider using one of your personal credit cards strictly for business purchases. If you’ve been mixing personal and business credit card purchases on the same card, you’ll be pleasantly surprised at how much easier your bookkeeping will be.

By using a business credit card, you can also build business credit, as many of these cards report payments to business credit bureaus.

4. Make friends with a bookkeeper

Yes, I’m a financial writer. Still, there were two tasks I dreaded most in my business: chasing payments from clients and bookkeeping. While I never learned to love bookkeeping, as I became more competent with the accounting program I used, I found I dreaded it less and less. The year I was able to turn my information over to my accountant in January instead of July (with extensions) was a cause for celebration.

If this isn’t your forte, consider hiring a bookkeeper. But make sure you find someone who works with businesses like yours, is reliable, and can help you streamline the process. Then get them the information so information is updated monthly. Ensuring your books are up to date is one of the most important ways you can prepare your business for financing. Lenders may require up-to-date financial statements or recent tax returns and you’ll want to be able to hand those over quickly.

5. Brush up your business plan

If your business plan is out of date — or if it’s all in your head — it’s time to put it on paper. To be fair, many business financing options will not require a business plan. But one thing this exercise will do is force you to really think through how your business would use additional financing to grow.

Writing a business plan can help you answer the crucial question: “How will you use the funds?” A well-thought-out answer to that question can help you land coveted bank financing, but even if it doesn’t, it will help you understand how to leverage additional capital to grow your business while avoiding debt that can drag it down. There are many excellent resources for writing a business plan and help can often be found through SBA resource partners.

6. Check and monitor credit

Both business and personal loans often require good credit. Entrepreneurs are often surprised how often lenders will check the owner’s personal credit for business financing (including small business credit cards), and that some lenders check business credit as well.

Because many businesses and individuals have experienced financial problems this year, many lenders are tightening credit requirements. If you aren’t monitoring both personal and business credit, you should. Review your credit scores monthly and make sure you’re checking with all three consumer credit bureaus: Equifax, Experian and TransUnion. For business credit, the major bureaus are Dun & Bradstreet, Equifax and Experian. The good news is there are more than 138 places you can monitor your credit for free, including Nav.com.

7. Apply for financing before you need it

The old adage that “banks don’t want to lend you money when you need it” contains a kernel of truth. If you wait until you really need a small business loan, you may find it harder to qualify. Many entrepreneurs are still facing tremendous uncertainty, but others are doing all right and may think they don’t need financing. Again, we’ve learned this year how important it can be to overprepare. Getting a line of credit, vendor accounts or even a small business credit card can provide you with a little extra insurance if things change quickly — as we know they can.

Business Credit Reports Vs. Personal Credit Reports

If you’ve never checked your business credit, you may find it a different experience than checking your personal credit. There are 3 key ways business credit reports differ from personal ones:

Creditors not named

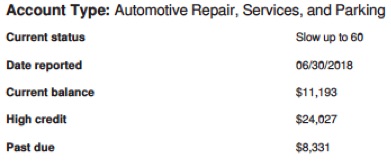

Your business credit report will list individual accounts by type of account, but won’t name the creditor. Here is an example of what that may look like:

Payment history summarized

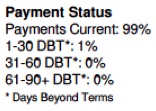

Under payment history, you’ll likely see an acronym: DBT which stands for “days beyond terms.” This is the number of days past the due date you paid your bill or invoice. For example, if you have net-30 terms and you pay on day 32, your account will list 2 DBT. And then it may be summarized by the percentage of times it was paid on time. Here’s an example of how that may look on a business credit report:

No regulation

A strong consumer protection law, the Fair Credit Reporting Act, covers consumer credit reports. It gives consumers the right to free personal credit reports annually, along with timely investigation of disputes and corrections of mistakes. It also limits the amount of time negative information may be reported. There is no similar law for business credit reports, though, so you will need to be more proactive when it comes to checking and monitoring your business credit reports. Nav is currently the only source for checking free business credit reports from the three major commercial credit bureaus.

Find a Home-Based Business to Start-Up >>> Hundreds of Business Listings.