There is no doubt that technology has successfully democratised financial trading, empowering individuals, as well as major hedge funds and financial institutions, to make shrewd investments in everything from stocks and commodities to government bonds and cryptocurrencies. Many years ago, if you wished to place a trade in the stock market, you would have to telephone your chosen stockbroker and place an order. Investors had little to no idea of how their investments were performing until they were mailed their account statements.

Fast forward to the present day and even individuals (regarded in the industry as retail traders) can get real-time updates on the profits and losses of their investments and even find stock brokerage firms with the most competitive transaction fees. CFD trading apps give today’s investors immediate access to 15,000+ markets, spanning stocks, shares, forex and much more. Advanced trading charts and indicators allow for in-depth analysis of markets before, during and after executing trades. Risk can also be managed by implementing strict stop losses and take profit orders.

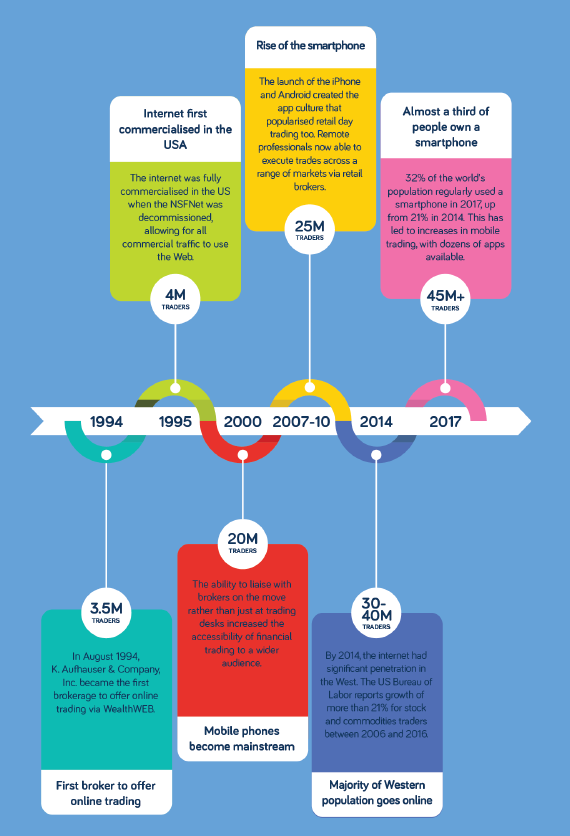

All of those charts and information are now available on handheld devices such as smartphones and tablets. It wasn’t until the turn of the millennium that trading desks were well-stocked with mobile phones that allowed traders to liaise with their brokers on the go.

It’s a far cry from the early days of trading terminals in the 1960s when Ultronics and Scantlin Electronics developed the first computerised trading terminals, giving traders the chance to automate tasks such as requesting stock quotes at the touch of a button. In 1989, the Sydney Futures Exchange (SFE) then unveiled SYCOM – the world’s first after-hours electronic trading system – that enabled traders to buy and sell ‘down under’ 24/7. In the present day, major trading organisations such as Bloomberg and Reuters still use trading terminals, but they are now cloud-based, allowing even retail traders to download the software and get access to real-time market news and pricing – providing they have a spare $20,000 a year to invest!

On top of that, there was never anywhere near the same amount of data available for retail traders to skim through and help inform future trading strategies. Big data has allowed investors to look at past scenarios and seek market trends that could be exploited the next time the same scenario occurs. Given the wealth of trading apps and data available at your fingertips today, dipping your toes into the uncertain world of financial investing does not seem quite so daunting; particularly if you are already a remote worker and have the time to dedicate in between your day job to learning the markets.

Once you get a feel for certain markets, you might even have the nous to develop your very own trading bot. Algorithms have been utilised by hedge funds and the world’s biggest banks for several years now to place high volumes of trades with unrivalled accuracy and speed. These bots are programmed to execute trades when certain criteria are met in the market; be it volatility, time, liquidity or a support or resistance point being met. The beauty of algorithmic trading is that it can operate in the background while you carry on with your day job. If you could possibly make a nice side income from learning market behaviours and developing some trading bots for the Australian Stock Exchange – or what is now known as the ASX Group – what could be better?

Conclusion

Technology has undeniably transformed financial trading, bringing it into the mainstream and making it accessible to both institutional investors and individual retail traders. From real-time mobile updates and advanced trading platforms to algorithmic bots that execute trades automatically, the tools available today allow anyone with dedication to participate in global markets. For those curious about how to become a financial trader, embracing these technological advances, learning to analyze market data, and gradually building experience are essential steps toward creating a successful and potentially profitable trading career.

Find a Home-Based Business to Start-Up >>> Hundreds of Business Listings.