Stablecoins have shown a steady growth in 2025, hitting new highs in terms of market cap as more Americans get into crypto. Today, the US stablecoin market is worth over $225 billion, with Tether (USDT) as the standout stablecoin.

This growing adoption has brought about a lot of regulatory scrutiny as crypto skeptics seek clarity on the legality and security of trading stablecoins. This piece highlights how these legal frameworks and customer protection policies influence USDT usage in the US and how Tether is adapting to become compliant.

How USDT Operates in the USA

The USDT remains the most traded crypto in the US thanks to its deep liquidity across regulated exchanges. While it is not considered a security by the SEC, USDT is mainly used to transact different cryptos quickly within the crypto ecosystem and without having to convert crypto into fiat.

Besides, the USDT is also quite popular among merchants involved in cross-border payments, especially to regions with high local inflation.

Legal Status of USDT Under US Regulations

The US currently classifies stablecoins such as USDT as payment stablecoins. The new GENIUS Act states that they are not treated as a commodity or security. The new legislation provides oversight on the crypto exchanges that allow the issuance and trading of USDT.

Therefore, exchange platforms must ensure that anyone trading stablecoins on their platforms must follow AML/CFT rules to allow transaction monitoring. What’s more, issuers are not allowed to pay interest on stablecoins.

How Americans Can Buy and Use USDT Safely

Americans mainly use USDT for crypto trading, leveraging its stability and low fees. Once you own USDT, you can trade it for other crypto on exchange platforms or use it to make payments using crypto debit cards or make direct wallet transfers.

Currently, ACH bank transfers are the most trusted payment method for anyone trying to buy USDT in the US. The ACH network runs on an existing bank regulatory framework and is quite reputable, and has very low fees on major exchange platforms. Here is a step-by-step guide on how to buy USDT in the USA on a reputable exchange platform using an ACH bank transfer.

1. Create and Verify Your Paybis Account

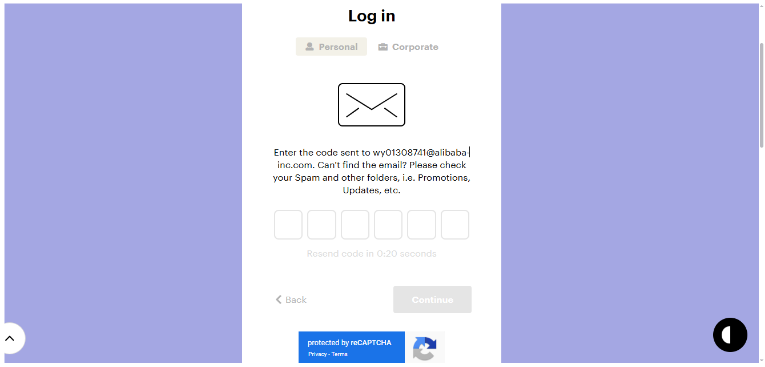

To create an account, visit Paybis.com and click on the sign-up option. The platform sends you a 6-digit code to your email and phone number to verify your account. You can then enter your name and residential address.

In compliance with the US regulations, Paybis also requires you to verify your identity by completing the KYC/AML procedure. You can’t move to the next step of purchasing USDT without completing this step. The process takes less than 5 minutes.

Once approved, you can now set up your account’s password and 2FA encryption.

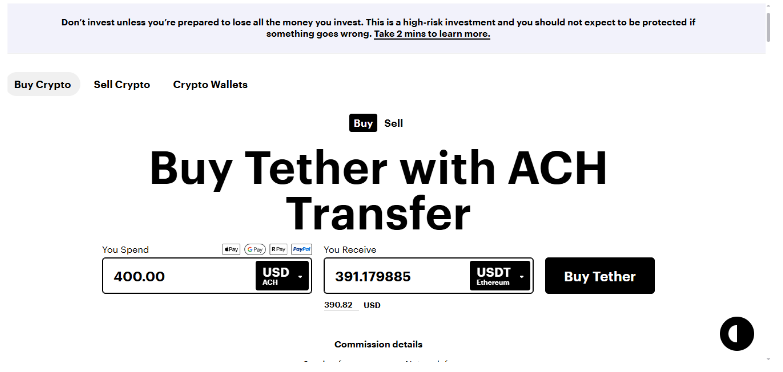

2. Choose ACH Bank Transfer as Your Payment Method

To buy USDT using ACH on the Paybis main page, head to the “You Spend” field and select ACH as your payment method. You’ll be prompted to link your bank account to allow instant billing. You can then enter the amount of USD you want to spend.

ACH bank transfer is quite straightforward and charges low fees compared to SWIFT or debit cards.

3. Enter Your USDT Wallet Address

After setting up the payment method, select USDT in the “You’ll Receive” field. The field automatically updates the amount of USDT you’ll receive based on the amount of USD you’re willing to spend.

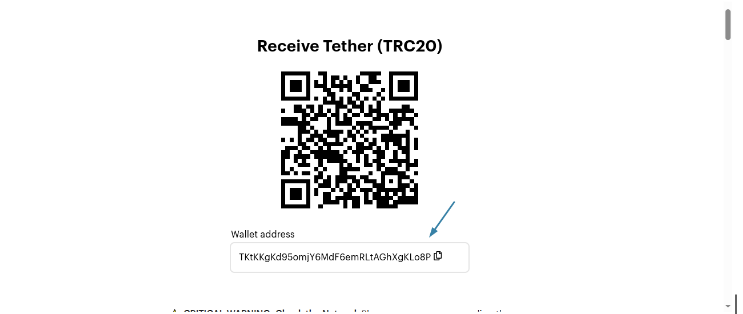

When you click Buy Tether, you’ll be prompted to add a USDT legal destination wallet where your purchased USDT will be sent. You can opt for a Paybis Wallet or an external wallet.

Ensure to cross-check this address thoroughly and double-check that you have selected the right network. Get any of this wrong, and you’ll lose your funds permanently.

4. Complete the ACH Transfer and Receive USDT

After completing the ACH transfer process on Paybis, wait 1-3 business days for the bank to settle the transaction. The USDT will be credited to your added wallet. You’ll also receive an email confirmation that the transaction is complete.

The ACH bank transfer on Paybis is secure because the platform uses a multilayered security framework, including industry-standard TLS encryption and PCI-DSS certification.

3 Key Concerns About Using USDT in the US Market

While USDT remains a dominant crypto in the US, it has had to deal with sustained criticism regarding regulatory compliance and potential de-pegging risks due to a lack of US licensing. From exchange vulnerability due to phishing scams to user errors that lead to permanent loss of funds, you need due diligence when dealing with crypto. Read more on what TXID is to understand how your USDT legal transactions are recorded on the network and how you can track them.

Let’s look at 3 key concerns facing USDT in the US market today.

1. Regulatory Ambiguity and Stablecoin Guidance

The recently enacted GENIUS Act has helped address some of the regulatory ambiguity associated with stablecoins in the US. However, there is still a need for clarity on how exchange platforms operate and their risk management standards.

The government is still finalizing aspects of consumer protection, such as dispute resolution mechanisms, as well as the specifics of reserve audits for stablecoin issuers.

2. Counterparty and Issuer Risk

While USDT is pegged to the US dollar, Tether’s criticism has always been on its lack of proof that the network has segregated reserve assets and operational funds. A stablecoin’s issuer must be transparent on its reserve backing as set out by the GENIUS Act.

3. Platform Security and Custody Risks

Beyond government regulations on stablecoins, users need issuer platforms that guarantee the security of their USDT. The best exchanges and wallets undergo significant security audits for user safety. That said, you need to always set up 2FA and secure your recovery phrases wherever possible.

Your Next Move and Important FAQs

USDT has played a huge role in stablecoin adoption in the US by being the primary liquidity instrument in crypto. However, while it is generally legal to trade in the US, you need to keep in mind that the ever-dynamic regulations influence its growth. That’s why it’s advisable to trade it on regulated exchange platforms and store it in secure wallets.

FAQs

Is USDT taxable in the USA?

Only transactions involving USDT are taxable. Holding USDT is not a taxable event.

Is USDT the same as the US dollar?

No, USDT is a cryptocurrency (stablecoin) while the USD is a fiat currency.

Can I convert my USDT to USD?

Yes, you can convert USDT to USD on a regulated crypto exchange platform.

Can I convert my USDT to cash?

Yes, you can sell your USDT to a fiat currency and then withdraw it to your bank account or digital wallet.

Is selling USDT legal?

Yes, selling USDT is legal as long as it is done on a reliable crypto exchange.

Find a Home-Based Business to Start-Up >>> Hundreds of Business Listings.