The International Fuel Tax Agreement (IFTA) is a tax agreement between the United States of America and Canada to assist in free trade and to ease the payment procedure of fuel taxes that need to be paid for freight traveling between the two countries.

How Does IFTA Work?

Prior to the implementation of IFTA each vehicle performing inter-jurisdictional delivery or shipping of freight was required to pay a separate fuel tax in each jurisdiction. This required getting a fuel tax sticker for each state which slowed down the supply chain and increased the complexity in fuel tax payment. The IFTA was established to remove all these complexities involved in the payment of fuel tax.

Under the IFTA the truck driver will need to report the net fuel consumption to their base state, the base will be responsible for collecting and distributing the fuel tax owed to relevant states and will also collect tax owed by various states. The IFTA allows the trucks to pay a single fuel tax across the US and Canada and recalculate and redistribute the taxes to their relevant states. This is drastically simplified the fuel tax procedure for many trucking companies and has brought a higher level of transparency to the system.

The taxes are distributed according to the miles driven in each state. This means, if a driver fuels up their vehicle in one state and then proceeds to drive through multiple states, the fuel tax will need to be paid to the states the driver has driven through, based on the miles covered in each state.

Example: If a vehicle is traveling from Washington to Minnesota, fuels up in Washington and drives through, Idaho, Montana and North Dakota to reach its final destination in East Minnesota, fuel tax will need to be paid for Washington, Idaho, Montana, North Dakota and Minnesota according to the fuel tax in each state and the number of miles traveled in each state. Even if fuel was not purchased in the other states.

This means, that if you purchase fuel in a high fuel tax state and travel through low fuel tax states, you may receive tax credits and inversely if you purchase fuel in a low fuel tax state and drive through high fuel tax states you might end up owing taxes to those states. IFTA reports are calculated each quarter and any tax credits or taxes due will need to be settled at the end of each quarter.

IFTA Calculation

There are two things you should keep on-hand to calculate your fuel tax.

Total Miles traveled in each state

Total Gallons of Fuel Purchased

You will first need to calculate the overall fuel mileage. This can be determined using the following formula

Total Miles Driven / Total Gallons of Fuel Purchased = Overall Mileage

Once you have determined your overall mileage you will be able to calculate how many Gallons of fuel you have burned in each state using the following formula.

Miles Driven in Each State / Overall Mileage = Gallons Burned in Each State

Once you have determined the Gallons Burned in Each State you will need to calculate the fuel tax owed in each state. The following formula is used to calculate the fuel tax owed in each state.

Gallons Burned in the State x Fuel Tax Rate of the State = Fuel Tax in the State

Some states have a surcharge on fuel. You can calculate the surcharge on fuel using the following formula.

Gallons Burned in the State x Fuel Surcharge of the State = Fuel Surcharge Owed in the State

In some states, you can pay the fuel tax in the pump as you fill it up. The following formula is used to calculate the fuel taxes already paid by the driver.

Gallons Burned in the State x Fuel Tax Paid in the State = Fuel Tax Paid in the State

Finally, you can calculate the total fuel tax you owe in each state by using the results from formula 3, 4 and 5.

(Fuel Tax in the State + Fuel Surcharge Owed in the State) – Fuel Tax Paid in the State = Fuel Tax Owed in the State

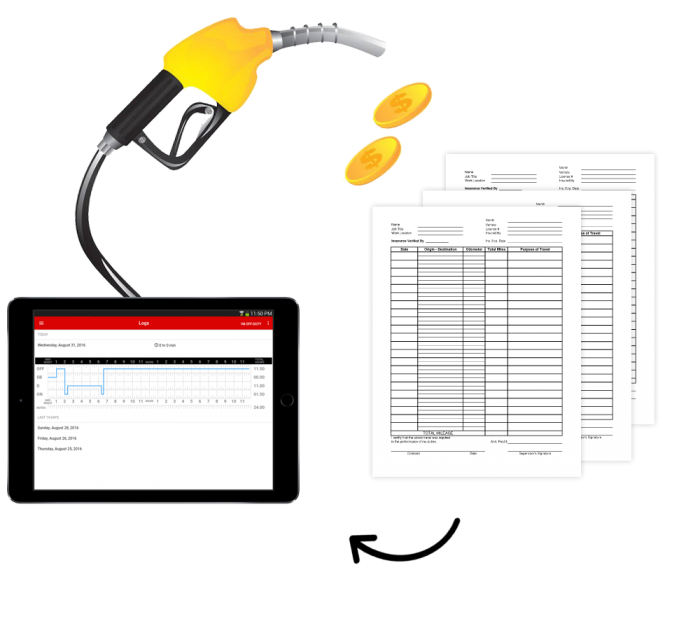

How a GPS Tracking Device Helps with IFTA Reporting

There are a number of fleet tracking and management software and hardware on the market today. GPS trackings devices being some of the most common among them. The GPS tracking device uses satellites to triangulate your vehicle’s location and its movements, keeping a track of all movements and storing it. You can use this data to improve the efficiency of your fleet and reduce costs. One of the major advantages of using a GPS tracking device is the fact that you will be able to get all the data you need to fill in your IFTA reports in one place. There are also GPS trackers that come with IFTA specific software to record data in a way that is easily exportable for IFTA calculations.

Another advantage of using GPS tracking devices for IFTA calculations is the level of accuracy these devices provide for calculations, it also ensures that you do not default of IFTA tax payments. The penalties for defaulting of IFTA payments can be quite hefty. A penalty of $50 or 10% of the defaulted amount, whichever is higher, will be charged for failing to files taxes, late filing of taxes or underpaying fuel taxes due.

Find a Home-Based Business to Start-Up >>> Hundreds of Business Listings.