Selling a house isn’t as easy as many people think. While the thought of getting a large sum of money may seem great, unfortunately, selling a home is not that straightforward. There are a lot of unexpected costs that arise during the process of selling a home.

Sellers should be prepared for these costs so that they are not blindsided when it comes time to close and sign the house over to the new owner.

1. Renovations and Repairs

Home renovations can improve the value and help maximize the amount of money that sellers get for their homes. Unfortunately, these renovations are often pricier than sellers expect. For example, installing new floors or upgrading kitchen appliances can cost thousands of dollars. The good news is that a seller usually sees a return on these renovations when selling the property.

Renovations are typically noticeable changes to the appearance of the home that add value to the property. However, repairs are usually more hidden. Many necessary repairs do not surface until the inspection. These repairs may include mold remediation and termite extermination as well as repairing the roof or cracks in the foundation, replacing old plumbing, and fixing the air conditioning unit.

Sellers can fix some minor repairs, but major repairs like the ones listed must be done by a professional. To offset this cost, homeowners should try to fix problems as they occur in the home to avoid major costs when it comes time to sell.

2. Decluttering and Cleaning

Decluttering and cleaning the home helps it sell much faster. Luckily, these costs are not too high, but they should be taken into consideration. For example, painting the walls of the home neutral colors will add to the appeal, while dirty walls or bold colors are a turn off to buyers.

Decluttering the home is very beneficial, as well. It allows buyers to picture how their belongings would look in the space without clutter fogging their imagination. Decluttering will also make the space appear larger and more open. Sellers can hire professional organizers for particularly cluttered homes.

In addition to decluttering, professional cleaning will do wonders for a home. A house cleaning costs $150 on average, while carpet cleaning ranges from $100 to $200. Grimy carpets will make it look like it needs to be replaced, and a dirty home will scare away buyers. These things are low cost but add to the overall expenses of selling a home, so they are important for the seller to keep in mind.

3. Staging

If you are selling your home but no longer living in it, you may want to consider staging. Of course, staging a home is an optional expense when it comes to selling a home; however, it can help it sell. Staging companies will provide enough furniture to the home, making it appear larger and giving the room a purpose. It helps home buyers envision how the home will look with their furniture in it. Sellers that chose to stage the home spend $1,200 on average.

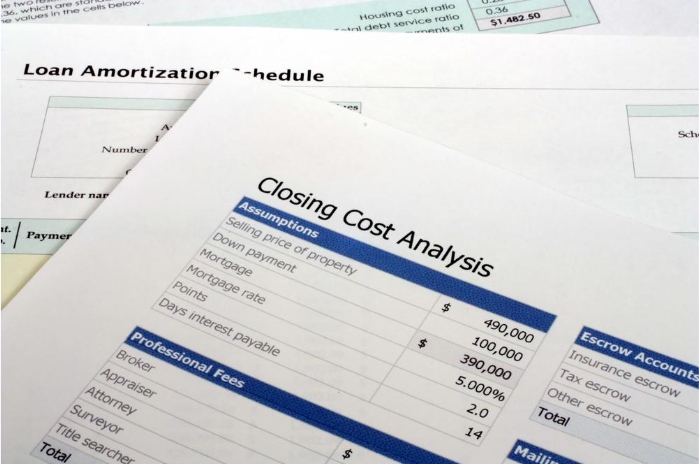

4. Closing Costs

Closing on a home is when the most unexpected costs arise. The seller pays for most of these costs, which make up one to two percent of the home’s selling price. Hidden closing costs include title insurance, tax transfer costs, deep preparation, attorney fees, and unpaid dues to the homeowner association.

Title insurance and tax transfer costs are the most frequent closing fees. The seller is responsible for purchasing title insurance for the buyer, which costs anywhere from $750 to $1000. Not every city or county requires transfer tax, but it is a percentage of the sale price.

5. Commission Fees

An advantage of working with real estate agents is that they negotiate on behalf of clients to compromise for the best deal for both parties. Realtors also spend time marketing the home, hosting open houses, and showing it to potential buyers. Of course, they need to be compensated for their work. Sellers are responsible for paying commission for both their real estate agents and the buyers’ agent.

Commission fees are typically three percent of the sales price for each agent. For example, the median home listing price in the United States is $280,000. Three percent of this price equals $8,400. To pay each agent, the seller will spend $16,800. Commission fees are usually the highest cost among unexpected fees for sellers.

6. Low Appraisal Fees

Before closing on a home, it is usually inspected and appraised. Unexpected costs can arise if the house’s appraisal value is under the previously agreed upon sale price. It could cost the seller up to five percent of the price in order not to lose the sale altogether.

These costs are all derived from traditional home-selling methods. Using a real estate agent or selling the home yourself is a great option if the home is in good condition, and the seller is not in a rush. Using traditional methods, sellers get the biggest return on investment. They usually have plenty of money to pay off the mortgage with additional cash to put towards a new home or straight into their bank account.

Other Selling Methods

An alternative method of selling a home is using a real estate investing firm. These companies buy homes for cash with no additional costs to the seller. They cover all repairs and closing costs and can close within seven to ten days. This is a great option for homeowners that are on a time crunch to sell their home because of foreclosures, relocations, or any unforeseen circumstances that may arise. Unfortunately, sellers do not always get the highest value possible for their home when using a real estate investor.

When deciding on what method you want to use when selling your home, it is important to understand the potential hidden costs that may arise throughout the entire home-selling process.

Find a Home-Based Business to Start-Up >>> Hundreds of Business Listings.