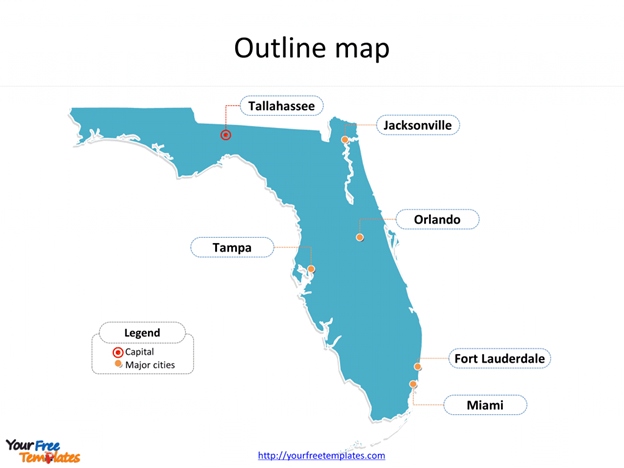

Florida’s economy is booming—more than 2,000 new companies filed formation paperwork every week last year. If you want to keep top talent, offering a smooth, smart 401(k) is no longer a nice-to-have; it’s table stakes.

Yet what looks “simple” on the surface hides real complexity. ERISA, the IRS, and SECURE Act 2.0 dictate everything from auto-enrollment defaults to fiduciary file-keeping. Miss a step and you could face penalties, audits, or even lawsuits.

That’s why many Florida employers—two local teams on NAPA’s 2024 Top DC Advisor list alone oversee $31 billion across 78 workplace plans—hand the wheel to specialists who live and breathe employer retirement plans.

Why you Benefit from a Dedicated 401(k) Consultant

Running payroll is one task; curating an investment menu, interpreting ERISA, and filing every notice on time is another. That gap is where a employer retirement-plan consultant steps in.

Think of the consultant as your plan’s chief operating officer. They design provisions that fit your workforce, negotiate record-keeper pricing, and document every investment decision exactly the way regulators expect. That documentation matters. During an audit, the Department of Labor asks one question: “Show us your process.” A seasoned adviser hands over a pristine fiduciary file and moves on.

Fiduciary liability is the big lever. Under ERISA you serve as a plan fiduciary by default, which means personal liability if fees run too high or funds underperform. Transfer those investment calls to a 3(38) discretionary manager and the risk sits on their shoulders, not yours. Prefer to keep final say? A 3(21) co-fiduciary still guides you while letting you approve each move. Either structure is far safer than going it alone.

Compliance is only half the story. Great employer retirement plan consultants also lift employee outcomes. They host bilingual workshops, drop easy-to-digest videos into Slack, and nudge contribution rates up a notch each year. Higher participation reduces turnover and shows that your company invests in people, not just profits.

Gallagher’s retirement-services page puts it plainly: independent advisers “help employers understand their fiduciary duties, establish prudent investment processes, and document compliance efforts,” which reduces risk and improves employee readiness.

Fizkes | Dreamstime.com

Our Methodology

You deserve to know how this list came together. We didn’t spin a wheel or skim a few Yelp reviews. Instead, we followed a repeatable, six-step process that aligns with the “prudent due-diligence” standard regulators expect.

First, we mapped the market. We scraped Google for every “best 401(k) advisor Florida” variant, pulled Form ADV filings, and cross-checked the National Association of Plan Advisors database. That sweep surfaced more than 80 firms with a meaningful footprint in the Sunshine State.

Next, we set the bar. To qualify, an employer retirement plan consultant had to be headquartered in Florida or run a sizable office here. They also had to act in a documented fiduciary capacity (either 3(21) or 3(38)). Commission-only sales shops were cut immediately.

With the pool set, we scored each candidate across five pillars:

- Fiduciary depth: designations such as CFP®, AIF®, or CPFA® on the team.

- Experience and scale: years in business, number of plans, and assets under advisement.

- Service stack: plan design skill, investment monitoring, employee education, and tech tools.

- Fee transparency: clear, competitive pricing free of hidden revenue-sharing.

- Reputation: client reviews, third-party awards, and any disciplinary records.

Each pillar carried a weighted score. Fiduciary depth and fee clarity counted double, because conflicts of interest erode trust fastest. We then verified every data point against public filings and, when available, firm-provided decks.

Finally, we applied a Florida filter. Does the team understand hurricane preparedness meetings in August? Have they guided employers through the state’s fast-growing hospitality and healthcare sectors? Local fluency mattered.

The result is a curated Top 12 that blends national muscle with hometown savvy. While no list is perfect, this one offers a transparent, apples-to-apples comparison you can trust when choosing your next retirement-plan partner.

1. Signature Financial Solutions, Tampa

Signature Financial Solutions feels more boutique than big-box, yet the team oversees hundreds of employer plans across Florida, from city utilities to mid-size tech firms. They act as a fee-based 3(21) fiduciary, and their 401k plan advisory services, which cover plan design along with detailed risk and cost assessment, can shift to full 3(38) discretion when you prefer to off-load every investment call.

What sets them apart is transparency. New clients receive a one-page fee schedule and a signed fiduciary oath before any paperwork moves. Advisers then benchmark every record-keeper invoice so your committee sees, line by line, where dollars go.

Education is equally hands-on. Bilingual workshops, on-site “office hours,” and an online NextPhase tool help employees translate balances into future paychecks, turning abstract savings into clear retirement income.

Ideal Fit:

Florida businesses with 25 to 500 employees that want one team to handle plan design, investment monitoring, and employee coaching without juggling multiple vendors.

2. Captrust, Lake Mary / Tampa

Captrust brings Wall Street research to Main Street plans without burying sponsors in jargon. The national RIA’s Florida teams advise more than forty workplace plans that together hold $21 billion in assets. Scale matters because it unlocks institution-level pricing on record-keeping and fund lineups, savings small employers rarely capture alone.

Every engagement begins with an Investment Policy Statement written in plain English. From there, Captrust’s analysts score each fund quarterly, and your committee receives an easy-to-read heat map that flags anything drifting off mandate. Sponsors who want extra peace of mind hand full discretion to Captrust under a 3(38) contract; others keep final approval under 3(21) advice.

Participant outreach is another strength. Advisors host on-site “retirement check-ins,” then follow up with personalized action plans delivered through a secure portal. Participation rises, loan balances fall, and HR finally gets numbers that prove the benefit works.

Ideal Fit:

Companies with five million dollars or more in plan assets, or fast growers on their way there, that want deep research, proven processes, and a local team that still answers the phone on the first ring.

3. SageView Advisory Group, West Palm Beach / Orlando

SageView blends national research power with a Florida handshake. Local advisors tap a coast-to-coast analytics engine yet still sit with plan committees to refine match formulas and auto-enrollment settings over coffee.

The firm can take full 3(38) control or share 3(21) duties, but each recommendation first passes SageView’s investment committee. That filter keeps “hot funds” out of the lineup and promotes low-cost index or collective-trust options.

Technology is another draw. Sponsors see participation, average deferral, and fund health on a traffic-light dashboard. When a metric slips, your advisor calls with a fix instead of burying you in spreadsheets. Employees benefit too; SageView logs every one-on-one session so HR learns which topics—Roth, loans, catch-ups—move the needle.

Ideal Fit:

Employers with ten million to five hundred million dollars in plan assets who want Fortune 500 analytics without losing hometown service.

4. OneDigital Retirement + Wealth, Orlando / Tampa

OneDigital began in health benefits, so its retirement team arrives with rare HR insight. That crossover helps you weave the 401(k) into a wider well-being program instead of juggling siloed vendors.

Florida offices—built from the 2020 Chepenik and later acquisitions—advise more than 90 plans and 40 000 participants. Advisors benchmark fees, refresh fund menus, and run financial-wellness campaigns that link saving to everyday money habits. Participation rises because employees see the plan in the context of paychecks, student loans, and medical deductibles.

OneDigital also guides sponsors through SECURE 2.0 features such as emergency-savings sidecars, keeping you ahead of regulation.

Ideal Fit:

Growing companies that want one partner for benefits, retirement, and people-data analytics.

5. Gallagher, Statewide

Gallagher blends retirement expertise with risk-management DNA. Plan sponsors gain a consultant who thinks like an insurance underwriter: every process documented, every liability labeled.

Most Florida clients hire Gallagher as a 3(21) co-fiduciary. Advisors follow a fixed quarterly rhythm—investment review, fee benchmarking, fiduciary-training refresh, and minutes ready for audit folders. If you want deeper support, Gallagher can add 3(16) administrative oversight so Form 5500 signatures and participant notices come from them, not your HR desk.

Cross-discipline strength appears when benefits overlap. Need to align phased-retirement incentives with retiree-medical costs? Gallagher’s health and retirement teams share the same roof, so modeling happens in one meeting, not three calls.

Ideal Fit:

Mid-size and larger employers, often 200 or more employees, whose board or city council demands airtight compliance and brand-name assurance.

6. Hub International, Fort Myers / Gainesville / Miami

Hub built its retirement practice by acquiring boutique advisors and keeping their local touch. You get a hometown employer retirement plan consultant backed by a national brokerage that negotiates volume pricing most mid-market plans never see.

Advisors start with fee hygiene. They dissect every basis point paid to record-keepers and funds, then present options that often cut total plan cost by 15 to 30 percent. The savings fund new features such as automatic escalation or a Roth match, which Hub’s communication team rolls out with multigenerational outreach: texts for Gen Z and lunch-and-learns for Boomers.

Because Hub also handles property-casualty and cyber risk, sponsors see fiduciary-liability coverage, bond renewals, and 401(k) metrics on one dashboard. Fewer vendors, more strategic work.

Ideal Fit:

Employers with 50 to 1 000 employees that want cost relief and personal service while keeping big-broker resources.

7. BKS Partners (Baldwin Risk Partners), Tampa / Jacksonville

BKS grew up in Florida and still operates like a neighbor who knows every shortcut around I-4 traffic. The employer retirement plan consultants manages more than one hundred plans yet keeps meetings intimate, often with a senior partner at the table rather than a junior analyst.

Because BKS also advises on commercial insurance and executive wealth, owners get cohesive planning. Need a cash-balance plan to boost tax deferral along with key-person life coverage? One strategy session covers both.

The advisory model is fee-based 3(21), and the team will quarterback outside TPAs and ERISA counsel so your staff handles no paperwork. Quarterly employee workshops, often timed before hurricane season to catch snow-bird staff, push participation metrics higher.

Ideal Fit:

Florida-centric businesses with five to fifty million dollars in plan assets that value personal rapport as much as technical skill.

8. Raymond James Institutional Fiduciary Services, St. Petersburg

Raymond James is Florida-born and publicly traded, so choosing its institutional team adds a Fortune 500 emblem to your fiduciary file. Headquarters talent in St. Petersburg supports local advisors statewide, giving small and mid-size plans direct access to Wall Street research.

The flagship offer is the SHRM 401(k) pooled employer plan. Join the pool and Raymond James serves as 3(38) investment manager while a third-party handles daily administration. For companies under 50 employees, this structure removes most paperwork and eliminates the annual audit.

Larger sponsors can opt for a stand-alone plan. Advisors craft an open-architecture lineup, monitor funds quarterly, and deliver one-on-one counseling that feels more private-bank than call center. Executives often stay with Raymond James for personal wealth management, creating continuity long after they leave the payroll.

Ideal Fit:

Very small employers seeking a turnkey pooled plan, or mid-market firms that want one brand for both corporate and personal advising.

9. The Ratay Group at Morgan Stanley, Fort Myers / Naples

Wirehouse resources with boutique attention—that is the Ratay promise. The team manages about $2 billion across more than fifty retirement plans, yet clients still have the lead advisors’ cell numbers.

Investment oversight follows Morgan Stanley’s institutional playbook: clear benchmarks, style-box neutrality, and a rule to replace any fund that fails two straight quarters. Sponsors receive color-coded scorecards that make committee decisions fast and defensible.

Employees gain extra lift. Employer retirement plan consultants host branch-by-branch planning days where staff can review Social Security timing, college savings, and rollover options, services smaller firms rarely provide in-house. That personal touch lifts deferral rates and builds goodwill toward the benefit.

Ideal Fit:

Plans above ten million dollars, or professional firms that want white-glove participant advice backed by a brand board members already trust.

10. Palm Beach PWM, West Palm Beach

Palm Beach PWM proves small can be mighty. Founder Elena Samofalova focuses on micro-plans—often five to fifty employees—and offers a rare triple fiduciary package: 3(16) administrative, 3(21) advisory, and 3(38) investment management. One signature lets owners off-load nearly every legal duty.

Cost control is her calling card. Elena benchmarks record-keeper bids, swaps high-expense funds for index alternatives, and credits back any revenue-sharing. Many clients cut plan fees by half within the first year.

Service stays personal. Employees text questions directly, and bilingual sessions ensure South Florida’s diverse workforce feels included. For startups unsure whether they even need a 401(k), Palm Beach PWM creates side-by-side comparisons of SIMPLE, SEP, and pooled plans so owners choose with full context.

Ideal Fit:

New or smaller companies that want full fiduciary outsourcing and white-glove guidance without big-firm prices.

11. Montanti Advisory Services, Boca Raton

Montanti has guided South Florida businesses since 1969, and that longevity sets the firm apart. Many clients are second-generation family companies that trust the same adviser who helped their parents retire.

The practice, affiliated with LPL Financial, serves as a 3(21) fiduciary. Meetings begin with tax-focused plan design, such as cash-balance add-ons or new-comparability formulas, because several partners hold CPA credentials. That accounting lens keeps contribution strategy and corporate cash flow in sync.

Montanti’s size allows deep personal attention. Advisors sit with every employee during enrollment to set an initial contribution, then return annually. For owners planning a sale or succession, these employer retirement plan consultants model how increasing a match or adjusting profit-sharing can boost valuation by improving employee retention.

Ideal Fit:

Closely held companies and professional practices that want decades-long continuity and advice combining retirement, tax, and estate planning.

12. Adcock Financial Group, Tampa

Adcock has spent nearly sixty years perfecting one craft: helping Florida employers turn benefits into a retention edge. The multigeneration firm now advises dozens of 401(k) and pooled employer plans while still greeting long-time clients by first name.

Employer retirement plan consultants act as fee-only 3(21) fiduciaries and can add full 3(38) oversight through partner platforms when you want every investment decision off your plate. Their early move into pooled plans stands out; small businesses join Adcock’s PEP to avoid audits and reduce record-keeping costs without losing flexibility.

Education is monthly, not annual. Short “money minute” videos land in employee inboxes, and on-site Q&A tables during open enrollment reinforce the message. The steady cadence keeps retirement top of mind and consistently lifts deferral rates.

Ideal Fit:

Employers in construction, hospitality, or healthcare that value proven staying power and forward-looking solutions such as PEPs and emergency-savings sidecars.

Quick-Glance Comparison

| Firm | Fiduciary role | Plans / assets | Notable edge | Best-fit plan size |

| Signature Financial Solutions | 3(21); 3(38) on request | Hundreds of plans, multi-billion AUA | Transparent fee oath; public-sector skill | $1 million – $100 million |

| Captrust | 3(38) or 3(21) | 40 plans / $21 billion (FL) | Institutional research, national leverage | $5 million – $1 billion+ |

| SageView Advisory | 3(38) / 3(21) | Dozens, mid-billions | Proprietary analytics dashboard | $10 million – $500 million |

| OneDigital | 3(21); 3(38) via partners | 90 plans / $2.6 billion (Tampa) | Integrates 401(k) with health benefits | $2 million – $250 million |

| Gallagher | 3(21); 3(16) add-on | Hundreds nationwide | Compliance-first, risk-management heritage | $5 million – $500 million |

| Hub International | 3(21) | 35 plans / $236 million (Ft. Myers) | Cost-cutting focus, multi-line brokerage | $1 million – $100 million |

| BKS Partners | 3(21) | 125 plans / $442 million | Boutique feel plus insurance resources | $5 million – $50 million |

| Raymond James | 3(38) PEP; 3(21) custom | Pooled assets; many small plans | SHRM pooled plan, Fortune 500 brand | $0 – $50 million |

| Morgan Stanley – Ratay | 3(21); 3(38) available | 59 plans / $2.1 billion | White-glove participant advice | $10 million – $250 million |

| Palm Beach PWM | 3(16), 3(21), 3(38) | ~15 micro-plans | Full fiduciary outsourcing for micros | $0 – $5 million |

| Montanti Advisory | 3(21) | 20 plans (est.) | CPA-driven tax integration | $1 million – $25 million |

| Adcock Financial | 3(21); 3(38) via PEP | Scores of plans | Early PEP adopter; monthly education | $2 million – $75 million |

Florida Retirement-Plan FAQ

Do we really need a consultant if our plan has only ten employees?

Yes. ERISA treats a ten-person 401(k) the same as a ten-thousand-person plan. A specialist keeps fees in check, prevents compliance missteps, and often finds pooled solutions that cost less than doing it yourself.

What is the difference between a 3(21) and a 3(38) fiduciary?

A 3(21) adviser shares liability, but you still approve every investment change. A 3(38) manager makes those decisions for you and carries the legal responsibility. Handing off discretion costs a bit more, yet owners who dislike fund-menu meetings usually consider it worth the fee.

How much should we expect to pay?

Small plans often pay about 0.50 percent of assets for full-service advice. Mid-size plans land closer to 0.30 percent, and mega plans dip below 0.15 percent. Flat-fee and per-participant models exist, but whatever the structure, insist on a written 408(b)(2) that lists every dollar.

Is a pooled employer plan right for micro businesses?

If you have fewer than 100 participants and dread audits, a PEP can help. The pooled provider files one Form 5500 and assumes 3(38) duty while you focus on payroll. The trade-off is less customization, so weigh culture-specific features, such as early eligibility or self-directed brokerage, before enrolling.

When should we switch from a SIMPLE IRA to a 401(k)?

Switch once owners want to save more than the SIMPLE cap of $17,000 or you expect to hire more than 100 workers. SECURE Act tax credits now cover up to 100 percent of start-up costs for many employers, shrinking the expense that once caused delays.

Conclusion

Bottom line: you grow the business; they guard the plan. Everyone wins.

Find a Home-Based Business to Start-Up >>> Hundreds of Business Listings.