Abstract

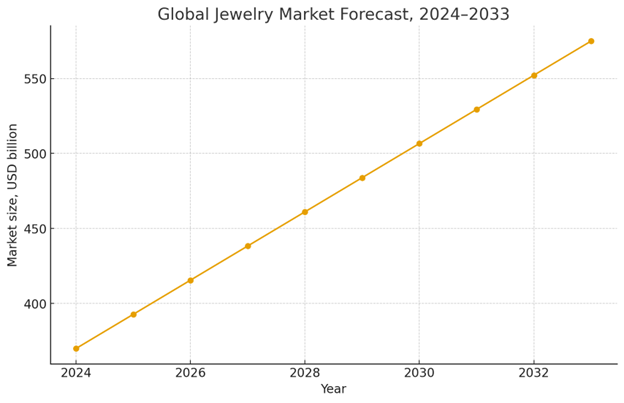

The global jewelry market continues to grow: according to analysts’ estimates, by 2033 its volume may exceed 570 billion US dollars, with an average annual growth of over 5%. Europe remains one of the key centers of demand, where the jewelry market is valued in tens of billions of dollars and shows stable positive dynamics. At the same time, competition is intensifying: a reliable assortment, delivery speed, and understanding of local demand are becoming critical factors for B2B clients.

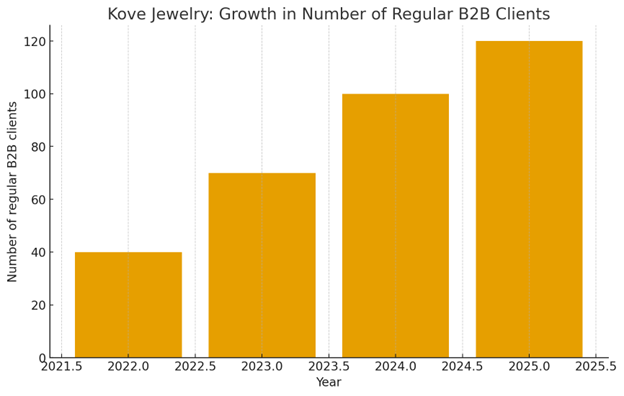

In such conditions, the experience of the family company Kove Jewelry s.r.o., founded in the Czech Republic and specializing in wholesale supplies of gold jewelry from Italy and Turkey, is especially illustrative. Over seven years in the industry and two years of work in the European market, the business has built a network of more than one hundred regular B2B clients in the Czech Republic, Slovakia, Poland, and Romania, relying on the principle of not “selling what the supplier has,” but first studying demand and ordering exactly the items that stores need.

The article examines how the family format of management and the focus on demand data help a wholesale jewelry business grow in the competitive environment of Central and Eastern Europe. The key elements of the model are described: working with Italy and Turkey as production centers, analytics of B2B clients’ needs, building trust in a family company, and rejecting retail and online sales as a conscious strategic decision. Special attention is paid to lessons for other entrepreneurs building international trade from a small base team.

Introduction: Why Jewelry Wholesale Is Not Only about “Beautiful Showcases”

According to industry research, the global jewelry market in 2024 is estimated at approximately 370 billion dollars and by 2033 may grow to 560–580 billion dollars. The European segment accounts for a significant share: the volume of the jewelry market in Europe is estimated in the range of 50–70 billion dollars with a growth forecast of 4–5% per year almost until the mid-2030s.

At the same time, the Czech Republic and neighboring countries have long been integrated into international supply chains: the Czech Republic is among the notable producers and exporters of jewelry, and the annual volume of jewelry exports is estimated at about 1 billion euros. Italy remains one of the world leaders in jewelry exports with a production value of around 15.5 billion euros, maintaining the status of a key source of gold jewelry for the European market.

Against this background, Kove Jewelry operates in a narrow but complex segment of international B2B gold supply, focusing on wholesale gold jewelry for B2B clients in four countries of Central and Eastern Europe. This is not a business of “beautiful showcases,” but primarily logistics, analytics, assortment management, and building trust.

1. Italian and Turkish Gold: How to Choose the “right” Production Centers

The basis of the Kove Jewelry model became two production directions — Italy and Turkey. The choice is determined by several factors:

Italy — one of the world leaders in jewelry exports, especially in gold jewelry. Italian factories set trends in design and technology, and their products are perceived as a benchmark of quality in the European market.

Turkey — a major player in the gold jewelry segment with high production flexibility, competitive prices, and fast manufacturing cycles.

For the B2B clients of Kove Jewelry this means:

• a wide assortment in terms of style and budget;

• the ability to quickly update collections to the tastes of end customers in the Czech Republic, Slovakia, Poland, and Romania;

• a balance between premium perception (Italian origin) and price competitiveness (Turkish supplies).

A key point: In international B2B gold supply, the company does not simply “take what the supplier has,” but builds relationships with factories as with partners who are ready to work according to request. This requires a larger amount of communication but provides a strategic advantage.

2. Demand Instead of “leftovers”: How the Reverse Assortment Planning Model Works

The main difference of Kove Jewelry from many wholesalers is its approach to the assortment. Instead of purchasing standard collections “by the box,” the company proceeds from the needs of B2B clients.

The model can be described in several steps:

Collection of Data from the Market.

The team systematically collects feedback from clients:

• which categories and designs sell best;

• which items regularly run out;

• which pieces are in demand in specific countries and cities.

Analytics by Countries and Clients.

Demand in Prague and in small towns of Romania differs, as does the client profile in Poland and Slovakia. The company identifies micro-segments:

• by the store’s average check level;

• by type of end customer (tourist flow, local regular clients, young audience, etc.);

• by design preferences (minimalism, classic, ethnic motifs).

Formation of Orders for Suppliers.

Based on this data, orders are formed for Italy and Turkey: not abstract “1000 units of chains,” but specific models, lengths, weaves, and shades that have already shown demand in previous seasons or have been tested through trial batches.

Testing New Items in Small Batches.

New designs and collections are launched in limited volumes. If turnover and margin indicators match expectations, the volume is increased; if not, the items are withdrawn without accumulating “dead” stock.

For a B2B store this gives a clear result: an assortment that feels “assembled for the client,” rather than a random mix of factory offerings.

3. The Family Format as a Quality Control System

Kove Jewelry is a family business. The management involves the spouse and sons, and the family controls all key processes:

• selection of factories and building partnerships;

• quality control of items at acceptance;

• decisions on assortment expansion or entering new markets;

• work with key clients.

This format gives several advantages within international B2B gold supply:

Low Level of “misalignment” of Interests.

There is no conflict between “hired top management” and owners — decisions are made quickly, with consideration of the long-term perspective.

Transparency of Processes.

Procurement, logistics, warehouse, sales, and client support are all in the focus of one team. This reduces the risk of errors in the chain and allows timely reaction to disruptions.

Culture of Responsibility.

In family companies, reputation is perceived literally as “the family name on the sign.” Any decision, from choosing a supplier to wording payment terms, is viewed through the lens of how it will affect long-term relationships with clients.

For more than one hundred regular B2B partners of Kove Jewelry, this turns into a clear advantage: the company is open to discussing non-standard requests, counting on flexibility without loss of quality.

4. Why a Deliberate Refusal of Retail and Online Is Also a Strategy

Over two years of work in the Czech Republic, Kove Jewelry tested retail formats and online sales. These attempts did not bring the expected result. The reasons are not in the weakness of the channel itself, but in the structure of the market:

• jewelry retail in the countries of Central Europe remains highly competitive and strongly tied to local brand and physical presence;

• online sales of jewelry require significant investments in marketing, content, and brand trust, which are difficult to recoup at the initial stage without large budgets.

As a result, the decision was made to focus on the wholesale model and B2B clients within international B2B gold supply, where there is a clear understanding of the company’s competence:

• understanding of logistics and customs procedures;

• the ability to work with assortment for different markets;

• established connections with factories.

This choice is important as an example for other entrepreneurs: not every channel fashionable on the market is obliged to be a source of growth within a specific business model. Sometimes strategic success is the ability to say “no” in time and focus on what brings maximum value to clients.

5. Lessons for Entrepreneurs Building International Trade “from Inside Europe”

The experience of Kove Jewelry can be scaled to other types of business in international B2B gold supply trade. Several key conclusions:

Demand Is More Important than a “beautiful Assortment.”

The winner is not the one who has more SKUs, but the one who better understands which items turn over faster and bring margin to partners.

The Family Format Can Be Turned into a Competitive Advantage.

With competent organization, a family business becomes a synonym of flexibility and a personal approach, not of a “small and unstable company.”

Focus on the Core Is Stronger than Spreading Across Fashionable Channels.

Attempts to be present simultaneously in retail, online, and wholesale often lead to dilution of resources. Concentration on the B2B model allowed Kove Jewelry to accelerate growth precisely in the segment where the company is objectively stronger.

Central Europe Is a Convenient Base for International Trade.

Prague as a logistics center, the developed financial and legal infrastructure of the Czech Republic, and proximity to the main EU markets create a good platform for companies working “at the junction” of Western and Eastern Europe.

Partnership with Manufacturers Is Stronger than Simple Procurement.

Turning factories into strategic partners (joint planning, testing of new items, flexibility in batches) increases the stability of the entire chain and reduces the risk of shortages or excessive stock.

Conclusion

The jewelry industry is perceived as a world of emotions, gifts, and aesthetics. But behind store showcases stand complex supply chains, demand analytics, and dozens of decisions that are made daily in wholesale companies.

Kove Jewelry demonstrates how a family business based in Prague and narrowly specialized in gold jewelry from Italy and Turkey can build a stable international B2B model:

• relying on demand data rather than a random assortment;

• turning the family structure into a system of fast and responsible managerial reaction;

• choosing a focus on the segment where maximum value is created for clients.

In conditions where the global and European jewelry markets continue to grow and competition for the trust of B2B partners intensifies, it is precisely such a combination — international expertise, family control, and a demand-oriented procurement model — that allows a small business to take a stable position in international trade.

Sources:

- Grand View Research. Jewelry Market Size, Share & Trends Analysis Report, 2024–2033.

- Market Data Forecast. Global Jewelry Market Report 2024–2033.

- Grand View Research. Europe Jewelry Market Outlook, 2024–2033.

- Expert Market Research. Europe Jewellery Market Report 2024–2034.

- IndexBox / аналитические обзоры по рынку ювелирных изделий в Европе, 2024–2025.

- Ministry of Foreign Affairs of the Czech Republic. Astonishing the World with Czechia’s Unique Jewellery, 2019.

- Confindustria Federorafi. Italian Jewelry Industry and Export Data, 2024–2025.

Find a Home-Based Business to Start-Up >>> Hundreds of Business Listings.