It feels like yesterday that delivery was an afterthought, a minor add-on to dine-in traffic. Yet here we are, staring down 2025, and the segment has morphed into the primary growth lever for many restaurants, ghost kitchens, and hotel-based outlets. Deciding which food delivery software to trust is now as mission-critical as choosing your chef or signing your lease. The good news: competition among platforms has driven a flood of features, lower costs, and better data. The bad news: sorting through slick sales decks and buzzwords can feel like a second full-time job.

We’ll cover the ten best tools, explain what makes each one unique, and finish with a roadmap for stacking multiple platforms without destroying margins. If you skim nothing else, remember that successful brands blend a direct channel they own with one or two aggregators for reach and visibility.

How We Ranked the Platforms

Choosing winners starts with understanding what “winner” means for a restaurant versus, say, a software investor. For operators, the holy trinity is profit, reliability, and brand control. Therefore, our scoring rubric focused on five operator-centric pillars:

- Margin Impact. Commission or subscription fees relative to the average ticket size.

- Scalability. Ability to expand from 50 orders a week to thousands without a tech overhaul.

- Operational Fit. Device flexibility, kitchen workflow tools, and driver coordination.

- Data Ownership. Access to raw customer data, API availability, and export options.

5. Market Penetration. Built-in demand that can fill tables (or ghost-kitchen racks) on Day 1.

Before diving into the ten picks, recognize that no single platform nails every pillar. Your task is to mix and match for an optimal blend of profitability and exposure.

The 10 Best Platforms at a Glance

This section presents each contender in detail. You’ll see a short synopsis, key strengths, drawbacks, and practical operator advice. We place paragraph-level context before bullet summaries so no subsection starts or ends abruptly, and so you can gauge fit without drowning in specs.

1. Delivety

Food Delivery software by Delivety positions itself as the polar opposite of commission-heavy aggregators. It’s a fully white-label, subscription-based suite that hands complete ownership of branding, menu, and customer data back to the operator. Think of it as Shopify for take-out rather than Amazon Marketplace.

Key advantages revolve around cost transparency and device agnosticism. Because everything runs in a browser, you can resurrect an old tablet as a Kitchen Display System or manage orders on a laptop behind the hostess stand. All tiers include an admin dashboard, recipe editor, and courier web-app, making it unusually comprehensive for its price.

| Pros | Cons |

| Zero commissions, predictable monthly cost | No marketplace traffic, you must self-market |

| Works on any phone, tablet, or PC | Requires staff time to configure menus and brand assets |

| Unlimited users, even on the Free plan | Subscription cost rises as you breach order thresholds |

From an operational viewpoint, Delivety shines when you have in-house marketing muscle or an existing customer base you plan to migrate to a direct channel.

2. DoorDash Drive

DoorDash’s consumer marketplace needs no introduction, but its B2B offspring, DoorDash Drive, is easily overlooked. Drive detaches the last-mile courier network from the consumer app, allowing restaurants to keep customers within their own web or mobile checkout while still sending a Dasher to the door.

Bullet Points for Busy Managers:

- POS integrations include Toast, Square, and Olo, cutting manual entry.

- Flat delivery fees simplify margin calculations.

- A full real-time tracking widget can be embedded on your website.

Caveat: Because couriers juggle orders from multiple merchants, you sacrifice some delivery-time precision. Operators should pad a five-minute buffer into quoted ETAs.

3. Grubhub for Restaurants

Grubhub spent two decades refining diner-side UX but has quietly upgraded its operator toolkit. This food delivery software now includes a vendor portal with self-serve menu edits, promo scheduling, and customizable delivery zones. Its biggest ace remains sheer marketplace demand, tens of millions of active diners in the U.S. funnel through the app every month.

Operators can negotiate lower commissions by providing their drivers or by agreeing to exclusive deals, but beware long-term exclusivity clauses. Use Grubhub as a high-volume channel, then steer repeat customers to your commission-free direct site with bounce-back coupons tucked into every delivery bag.

4. Seamless

Seamless is Grubhub’s urban-focused sibling, immensely popular in New York City. Scheduled ordering is its signature feature, allowing today’s lunch-breakers to pre-book tomorrow’s dinner. That predictable volume helps kitchens smooth mise en place and labor allocation.

For diners, “Save Favorite Order” reduces friction and encourages habitual re-ordering. For restaurants, that means a higher lifetime value per user but also stricter expectations around order accuracy. Implement double-check protocols at expo to maintain stellar ratings.

5. Zomato

Beyond its Indian stronghold, Zomato is gaining traction in the UAE, Singapore, and parts of Europe. The big differentiator is its dual identity as a Yelp-style review engine and delivery marketplace. Diners browse photos and read ratings moments before tapping “Order Now,” collapsing the discovery-to-checkout funnel into seconds.

If you are entering a new Indian city, launching on Zomato is nearly mandatory. The platform’s “Gold” subscription offers free delivery and free dishes on dine-in visits, so hybrid operators (delivery plus brick-and-mortar) can unify loyalty across channels.

6. Postmates

Uber acquired Postmates, which continues to pursue the audience of anything delivered. This is beneficial to restaurants as couriers already in the street delivering pharmacy products and coffee will have less delay in picking up during off-peak meal times.

Key safety note: The order that you make on the app may be in the same courier bag as an unrelated order. Use tamper-resistant labels and sequential label orders clearly so as to be able to avoid any confusion.

7. Foodpanda

Foodpanda’s edge is cost. Lower commission rates and perpetual promo codes woo diners in cost-sensitive nations like Thailand, Pakistan, and Romania. Restaurants can also accept cash on delivery, a lifesaver in economies where card usage is limited.

Downside:

Competition is fierce and brand loyalty shallow. Invest in high-quality images and compelling dish names; otherwise, diners scroll right past your listing in favor of a flashier thumbnail.

8. Just Eat

Just Eat’s “self-delivery” toggle can’t be overstated. It gives restaurants two strategic levers: lean on the platform’s courier network when internal staffing is tight, or flip to in-house drivers during slower periods to dodge commissions. The marketplace also enables pick-up orders, driving incremental revenue without inflating driver payroll.

Operators should treat Just Eat coupons as a channel acquisition cost, bundling them with profitable add-ons (desserts, drinks) to protect contribution margins.

9. Deliveroo

Deliveroo mixes marketplace scale with its Editions dark-kitchen program, offering pre-built culinary pods in high-traffic catchment areas. Rent includes utilities and marketing support, meaning you can test a new concept or geography with minimal cap-ex.

Equally powerful is Deliveroo’s heat-map data. Managers can visualize unserved demand pockets, say, sushi orders spiking in a borough with zero Japanese restaurants, before signing a lease or investing in a ghost kitchen.

10. Swiggy

Swiggy’s superpower is logistics. The platform layers live traffic data onto GPS to refine ETAs, which then auto-update kitchen ticket screens. That precision reduces sit-time (food waiting for riders) and cold-food refunds.

Cash flow also benefits from Swiggy Money, an in-app wallet paying out weekly. However, reconcile those payouts quickly; lagging ledger matches can snowball into hours of back-office work.

Crafting a Profitable Multi-Channel Strategy

A single platform rarely meets every need. The smart move is to build a stack that captures high-margin direct orders while leveraging aggregators for visibility. Below is a four-step model you can copy and paste into your growth plan.

Establish Your “Home Court”

Begin with a white-label or POS-integrated site (Delivety, Toast Online, or ChowNow). Every bag gets a QR code nudging diners toward this commission-free channel for their next purchase.

Layer in One Major Marketplace

Pick the aggregator dominating your zip code: DoorDash, Grubhub, Swiggy, or Zomato. Marketplaces operate as acquisition engines; accept the commission hit but treat their diners as leads to convert later.

Add a Price-Sensitive or Niche Platform

If your cuisine attracts budget-focused diners, try Foodpanda; if you serve upscale fare, Deliveroo’s user base may align better. Niche sites add incremental orders without cannibalizing your direct traffic.

Centralize Operations

Middleware like Otter or Deliverect funnels every ticket, regardless of origin, into a single kitchen screen, reducing chaos and printer spaghetti. This is where scalability becomes real, not theoretical.

Remember: technology is only a tool. Train staff on photo-worthy plating, timely bagging, and driver etiquette. A perfect tech stack can’t compensate for soggy fries or missing condiments.

Finance Check: The Numbers You Can’t Ignore

Only two stats matter when defending your delivery budget to ownership or investors, and they should guide every negotiation with food delivery software vendors:

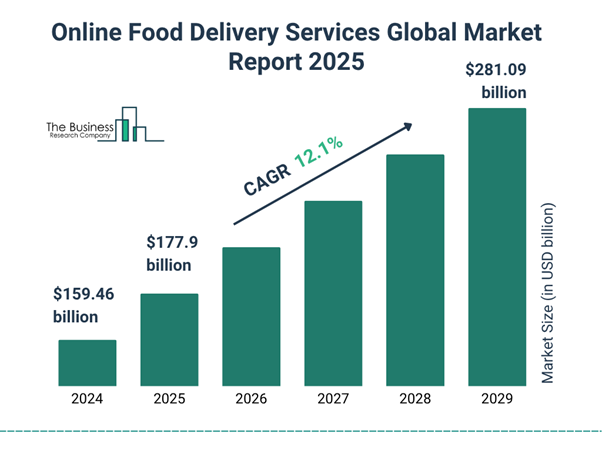

The global online food delivery software services market is projected to grow from $159.46 billion in 2024 to $177.9 billion in 2025, reflecting a compound annual growth rate (CAGR) of 12.1%. That pie is too large to ignore, but also too competitive to enter blindly.

Most restaurants have extremely slim profit margins – usually 3-7% of sales. When a restaurant has a 5% net profit margin and must give 20% of sales in delivery commissions, the bottom line gets disproportionately affected by even modest commission cuts.

To give an example of this scenario, say that delivery is 30% of sales with a commission of 20% so that is 6% of revenue going to commissions. A 5% decrease in the amount of commission (20% to 19%) would save 0.3% of total revenue (5% of that 6%). This 0.3% savings would be 6% of the net profit in a restaurant that has a 5% profit margin.

Use these figures in P&L presentations or landlord negotiations to contextualize technology spend. They’re not vanity metrics; they’re survival stats.

Final Thoughts

Delivery is no longer a tech experiment; it’s the cornerstone of revenue diversification for restaurants, virtual brands, and hotels alike. The smartest operators pair best food delivery software for restaurants with a layered strategy: combine a direct channel you control with one or two marketplaces that deliver eyeballs, then centralize order flow for sanity. Negotiate commissions hard, monitor data exports regularly, and keep an eye on emerging regional players who may offer better terms as they court new markets.

Above all, resist the urge to “set it and forget it.” Delivery platforms evolve quarterly. Review dashboards weekly, compare promised ETAs against actual hand-off times, and look for upticks in refund or adjustment requests. Technology succeeds only when paired with relentless operational discipline, and your guests can taste the difference.

Find a Home-Based Business to Start-Up >>> Hundreds of Business Listings.