Bean-to-bar: two growth trends in craft chocolate

According to forecasts from Mordor Intelligence, the global chocolate market is expected to grow an average of 4.5% per year through 2026, with premium and low-sugar offerings outpacing other segments.

Organic chocolate rose in popularity in 2020 in the context of the COVID-19 pandemic and the public’s increasing interest in healthy lifestyles. Europeans spearheaded this trend as the top consumers of craft chocolate, which is considered to be a healthier option with fewer calories and no additives or preservatives.

However, consumer preference for premium and craft products goes beyond health concerns. Contemporary food culture places a whole set of values on food that have nothing to do with satisfying hunger. Food is supposed to fill us with energy, help us relax, provide pleasure, and broaden our minds, all while nourishing our bodies. Environmental issues are also a top priority. World Chocolate Masters, one of the world’s largest competitions for pastry chefs and chocolatiers, highlighted climate concerns as a force shaping food industry trends. Consumer trials in the United States showed that craft chocolate has what people want right now.

Chocolate map

The global chocolate market has a clear dividing line between the countries where cacao beans are grown (subequatorial countries in Latin America, Africa, and Southeast Asia) and the countries with longstanding traditions of processing the beans into finished chocolate desserts (Europe and North America).

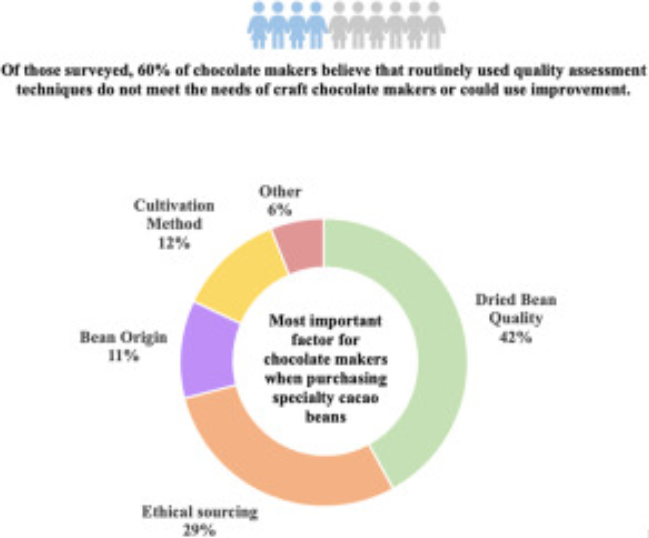

The market for craft chocolate is somewhat different: while industrial chocolate manufacturers buy most of their cacao beans in West Africa, over 65% of craft chocolate companies prefer to source beans in Central and South America. When polled, craft chocolate makers explained that they buy directly from growers for quality reasons (38%) and to be sure that the beans are grown and harvested sustainably (29%).

Latin American dilemma

Cacao-growing traditions in Latin America date back thousands of years, and today the region is one of the largest sources of beans for processing into chocolate. But the margin is thin for unprocessed beans, so locals are increasingly interested in the full cycle – growing, roasting, cleaning, separating, and grinding beans to make more profitable chocolate products.

Latin American-made chocolate lags behind European chocolate in quality, however, at least in the view of Dmitry Mateychik, the founder of Kadzama, a manufacturer of equipment for processing cacao and chocolate. Mateychik says that European chocolate makers, with over 200 years of experience, understand the tastes and preferences of their own local consumers better than the Latin American startups.

Latin American chocolatiers also face significant logistical hurdles, from the cost of shipping to the damage to both product and packaging that can happen when shipping chocolate by sea to Europe or North America.

Mateychik believes that growers would do better to focus on producing cocoa liquor, the semi-finished product that results when roasted beans are ground into a paste. Both industrial and craft chocolate makers need cocoa liquor to create finished chocolate products.

Kadzama’s solution

Growers need just three pieces of equipment to make cocoa liquor:

- A roaster for roasting cacao beans

- A grinder for grinding the beans and separating them from their shells

- A melangeur for turning nibs into chocolate liquor, the thick liquid that can be poured into blocks, packaged, and shipped

Kadzama sells all three as a kit designed for smaller growers processing up to 3-5 tons of product per month. The Russian company’s roasters, grinders, and melangeurs are more affordable for small Latin American businesses than equipment from global giants, and they quickly pay for themselves.

Kadzama now offers tools for every step of the handmade chocolate process, from cacao processing equipment to molds of all shapes and sizes. The company focuses on serving small businesses, which describes most craft chocolate makers. Besides selling equipment, the company holds classes where chocolatiers can expand their skills and learn how to make the most of Kadzama’s tools.

Global success working with Mosprom

Today, Kadzama sells to craft chocolatiers in 46 countries, and its equipment can be found in factories from Austria, Belgium, the United States, and Canada to Ecuador, the Dominican Republic, and China. Seventy percent of the company’s revenue comes from international sales, with the other 30% generated in Russia and other Eurasian Economic Union countries. And the company is experiencing dynamic growth: in the first half of 2021, Kadzama posted higher export profits than for all of 2020, with turnover of over EUR 2 million annually.

Kadzama’s head office is in Moscow, but it has a trading company and warehouse/transportation hub in Slovenia to quickly serve EU customers and reduce shipping times. The company has been selling in Europe since 2019.

From the get-go, the team at Kadzama knew that Russia’s craft chocolate market was so small that they would need a global focus. The Mosprom Export Support Center helped the company build bridges and get started. At the outset, the Center provided information about the EU market, including certification, regulation, and taxes. Later, the Center supported Kadzama when it made the rounds of international trade shows and advertised its products, as well as when it signed up with the B2B platform Europages.

“The food industry is a promising segment for exports from Moscow,” says Alexander Prokhorov, head of Moscow’s department for investment and industrial policy. “Local companies exported USD 139.89 million in confectioneries to 65 countries between January and August 2021. Chocolate accounted for about half of that volume, or USD 67.51 million, up 59.8% from the same period of 2019.”

Eye to the future

Kadzama’s next goal is to increase its export sales by building relationships with dealers, agents, and influencers. The Mosprom Center is ready to help the company at this new stage, too, including through the events it organizes. Participating in the Center’s group stand at a trade show in China brought the company a small contract and a large number of new contacts. Additionally, in September, Mateychik spoke about his company’s equipment and the opportunities it offers small chocolate makers during an online event called Step Forward: Exporting to Latin America.

With borders still closed and access to trade shows limited, a partner like Mosprom can help exporters get their products to foreign markets faster and more reliably. And it’s a win-win situation: Kadzama and other local companies use Mosprom’s services to build their businesses, bring new jobs to the city, expand its tax base, and confirm its status as a global high-tech capital.

Find a Home-Based Business to Start-Up >>> Hundreds of Business Listings.