It’s understood that when a customer swipes a card or enters payment information online, funds will ultimately move from the customer’s account to the merchant’s.

But, how do the funds move from one account to another? How long does it take? Are there costs involved?

Understanding the nuances of payment processing can help you make more informed business decisions. For further advice, you can find different tips for your business decisions at freebusinessideas.

Processing Procedures Depend on the Platform and Sales Method

The way in which your transactions are processed and how funds are made available for use will depend on the platform you use to process payments and the method you use to acquire sales.

For example, processing payments with PayPal is vastly different from transacting with a traditional merchant account. And online payment processing differs from in-person transactions. It may be a good idea to compare between high-risk merchant services if you want a variety of choices to consider.

In this article, we’ll explain how online payments are processed using a traditional merchant account.

The Four Stages of Payment Processing

There are four primary stages of payment processing for online transactions.

Authorization

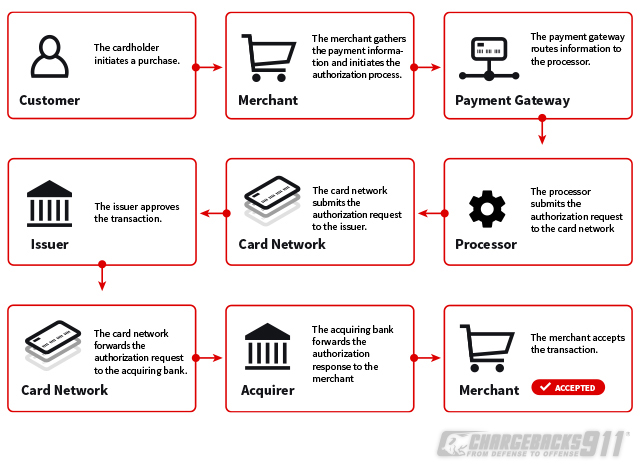

Authorization is the initial phase of a transaction. The cardholder initiates a sale, prompting the merchant to request authorization from the customer’s issuing bank.

If the issuing bank grants authorization, it means the cardholder’s account is in good standing, there are sufficient funds to cover the sale, and the card hasn’t been reported lost or stolen. The merchant can proceed with the sale. If the bank does not grant authorization, it means there is an issue with the account and the transaction should be terminated.

To request authorization, the merchant routes an authorization request through various relay points:

- Issuer: The bank that provides the consumer with a credit or debit card.

- Acquirer: The financial institution that provides the merchant account.

- Processor: The link between the acquirer and the merchant. The processor attends to all the payment processing tasks, but the acquirer holds the liability.

- Payment Gateway: The entity responsible for connecting the merchant to the processor, similar to a POS system for in-person transactions.

- Card Networks: Interbank networks that provide branded cards (MasterCard, Visa, etc.) to consumers and facilitate payments for merchants.

The entire authorization process takes place in a matter of seconds, but it does not finalize the sale. There are still several other stages that must be completed.

Batching

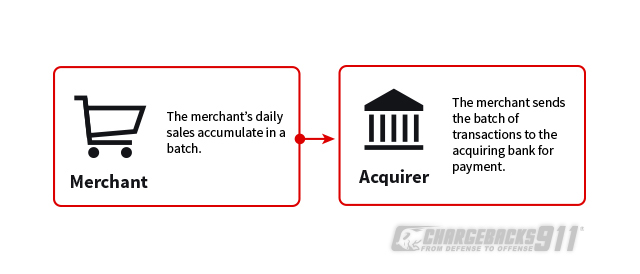

The next step in the process is batching.

Rather than using real-time data transmission to submit individual transactions to be paid one at a time, it’s generally considered more efficient for merchants to store transaction data and submit it in a batch.

Not only is this process more efficient, it also provides time to manually review each order and check for indicators of fraud. If fraud is detected, the transaction can be terminated. But if transactions are processed immediately without the manual review process, there is a strong likelihood that unauthorized transactions will be overlooked and the resulting chargebacks will cause significant revenue loss.

Clearing

At the next step in the cycle, the acquirer accepts the batched transactions from the processor and forwards them to the card networks. The card networks then distribute the payments to the corresponding issuer.

The issuer debits the cost of the transaction from the cardholder’s account, then routes those funds back to the acquirer via the card network.

Funding

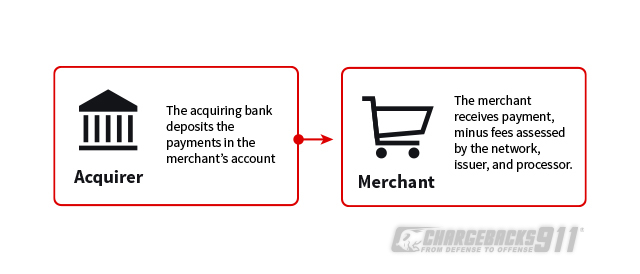

Funding is the last step in the process, at which point the acquirer deposits the money from the transaction into the merchant’s account.

Of course, the services provided by each party in the chain of events do not come free—the final total the merchant receives will be minus fees assessed by each party in the transaction.

- The interchange fee is paid to the issuer.

- The assessment fee is charged by the card networks.

- The processor’s fee is collected by the processor.

How Long Should This Process Take?

Merchants can typically expect the entire process from initiation to funding to take anywhere from 24-48 hours. However, there are several different factors which can impact that time frame.

- Time and day of the transaction

- Specific bank policies

- The merchant’s industry

- Perceived risk levels

If at any point merchants begin seeing excessive delays for the posting of their funds or funds are not received at all, inquiries should be made immediately. A revenue hold should not be taken lightly; rather, it should be considered a warning that there is trouble with the current processing arrangement.

Understanding Engenders Sustainable Decision Making

Payment processing is an essential part of any business model. Understanding the intricacies empowers merchants to make more informed decisions, in turn, leading to greater business sustainability.

Find a Home-Based Business to Start-Up >>> Hundreds of Business Listings.